Masters=>HSN/SAC Codes

HSN codes are used to classify the commodities into various sections, chapters, headings, and sub-headings for convenience. As per present GST rule, Businesses with turnover of more than Rs 5 crore will have to furnish six-digit HSN or tariff code on the invoices issued for supplies of taxable goods and services.

InvoiceNET® Lite has the facility to create & assign hsn/sac codes for products . It is also possible to print hsn/sac codes in invoices.

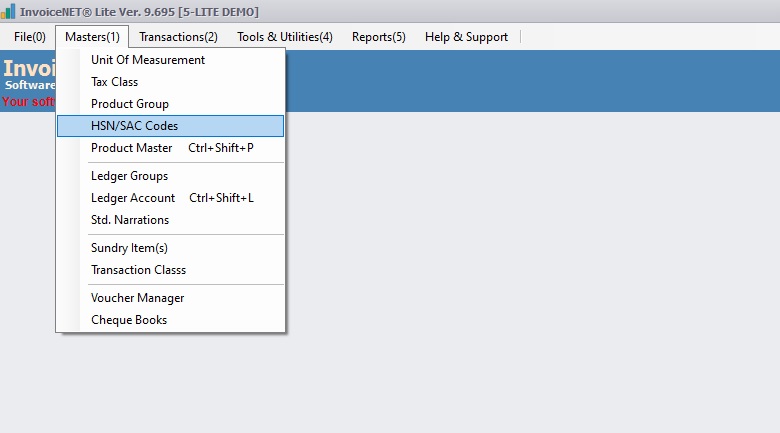

- Step 1

- Click Masters=>HSN/SAC Codes to create, modify or delete product groups as shown Step 1 figure

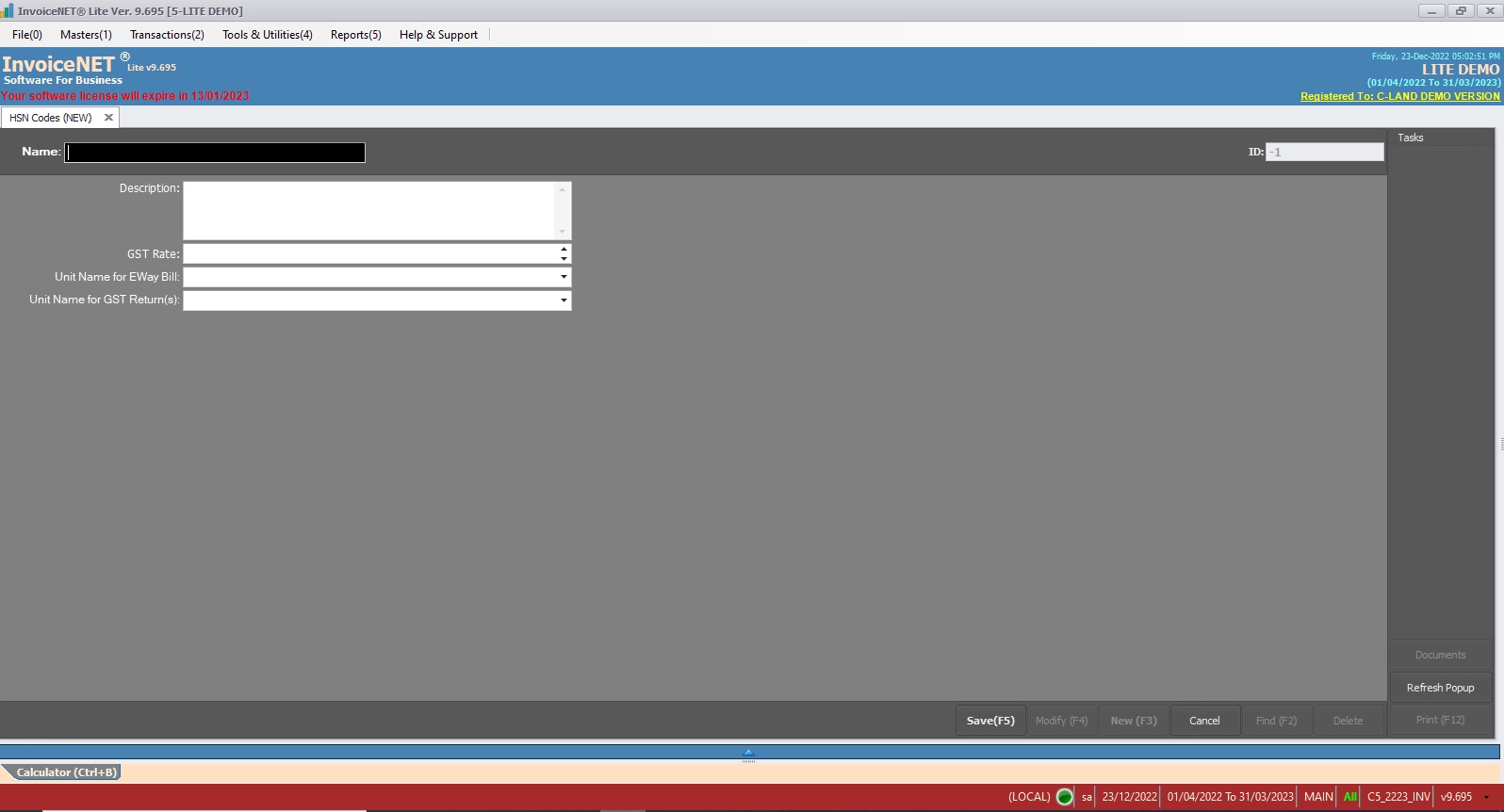

- Step 2

- Now HSN/SAC Codes creation window is appeared as shown in Step 2 figure

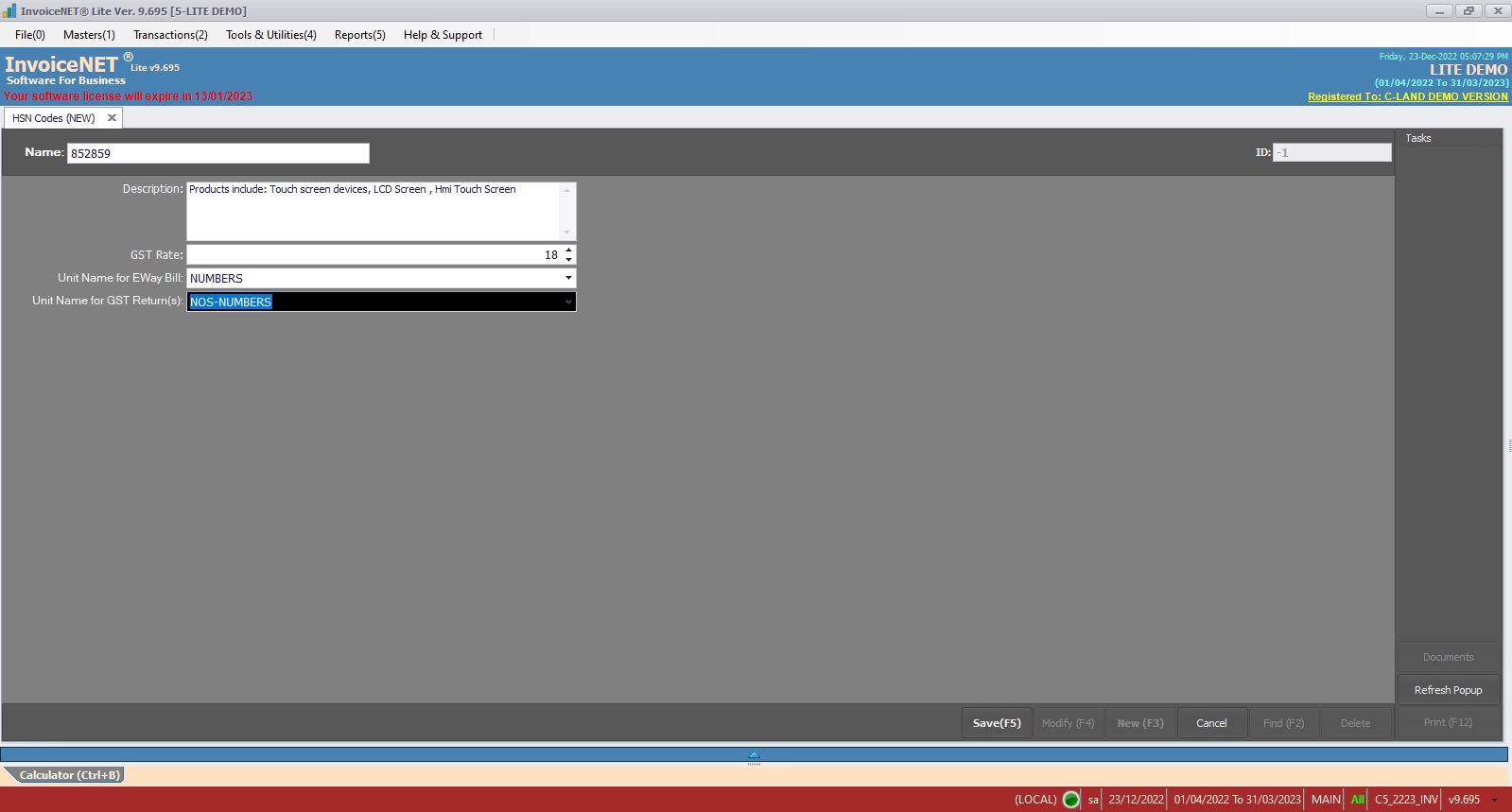

- Step 3

- User have to fill the text boxes as shown in Step 3 figure

- Name=>Enter new HSN Code here. It must be unique and compulsory

- Description=>Enter description of that HSN Code here. This one is optional and can leave as blank

- GST Rate =>Enter GST rate of the HSN Code here

- Unit Name for EWay Bill=>Press space bar to select unit name for EWay Bill here

- Unit Name for GST Return=>Press space bar to select unit name for GST Return here

- After filling above text boxes, need to click save button to create a new hsn/sac codes.

- User have to fill the text boxes as shown in Step 3 figure