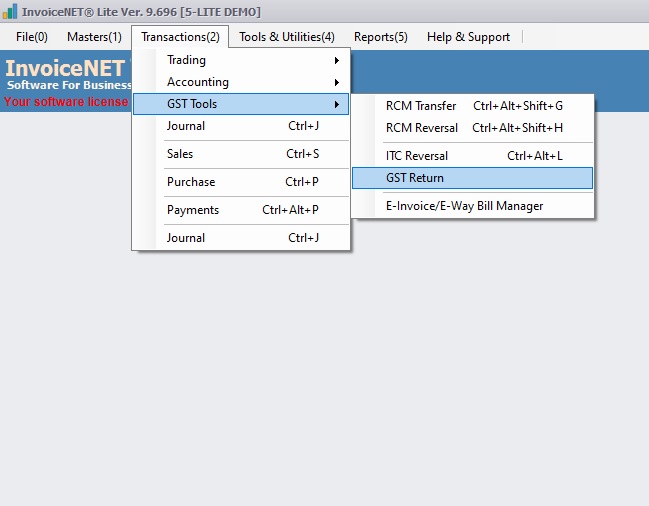

Transactions=>GST Tools=>GST Return

GST return is a tool that will contain all the details of your sales, purchases, tax collected on sales (output tax), and tax paid on purchases (input tax). It has all types of GST Returns for regular business

Step 1

- Click Transactions=>GST Tools=>GST Return to view GST reports as shown in Step 1 figure

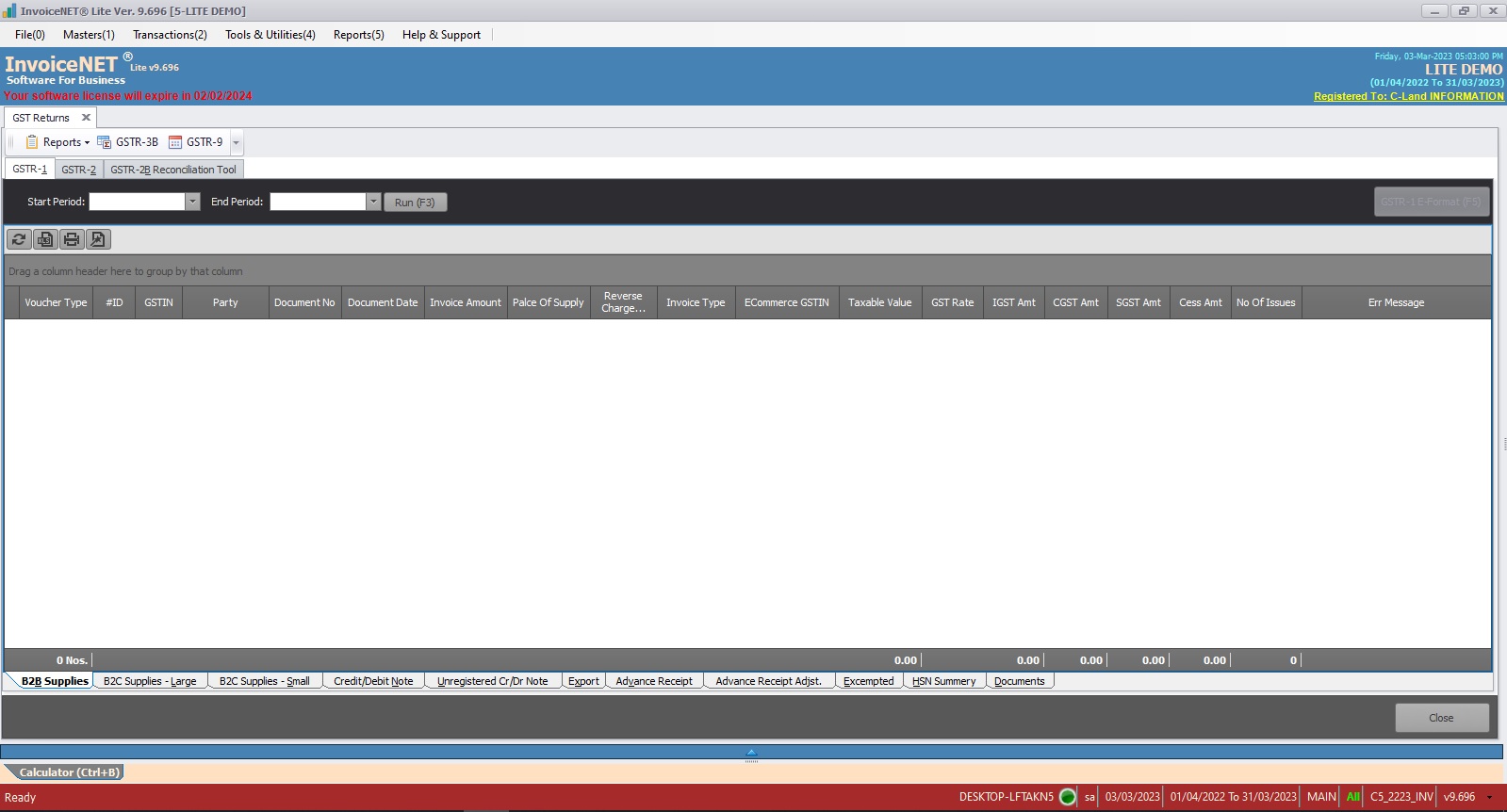

- Click On the needed GST return form tab. Available forms are

- GSTR-1

Tax return for outward supplies made (contains the details of interstate as well as intrastate B2B and B2C sales including purchases under reverse charge and inter state stock transfers made during the tax period).

- GSTR-2

Details of inward supplies made (contains the details of interstate as well as intrastate B2B purchases including reverse charge claim made during the tax period).

- GSTR-3B

Summary return of outward supplies and input tax credit claimed, along with payment of tax by the taxpayer.

- GSTR-9

Annual return by a regular taxpayer.

- Other available GST reports are

- Reports=>GST Rate-Wise Breakup

- Reports=>GST Analysis By Rate Of Tax

- Reports=>HSN Code-Wise Summary

- Available tools are

- GSTR – 2B Reconciliation Tool

GSTR 2B Reconciliation tool helps in a way that allows taxpayers to easily and conveniently reconcile ITC with books of accounts and records. It also assists them in compiling all of the information.

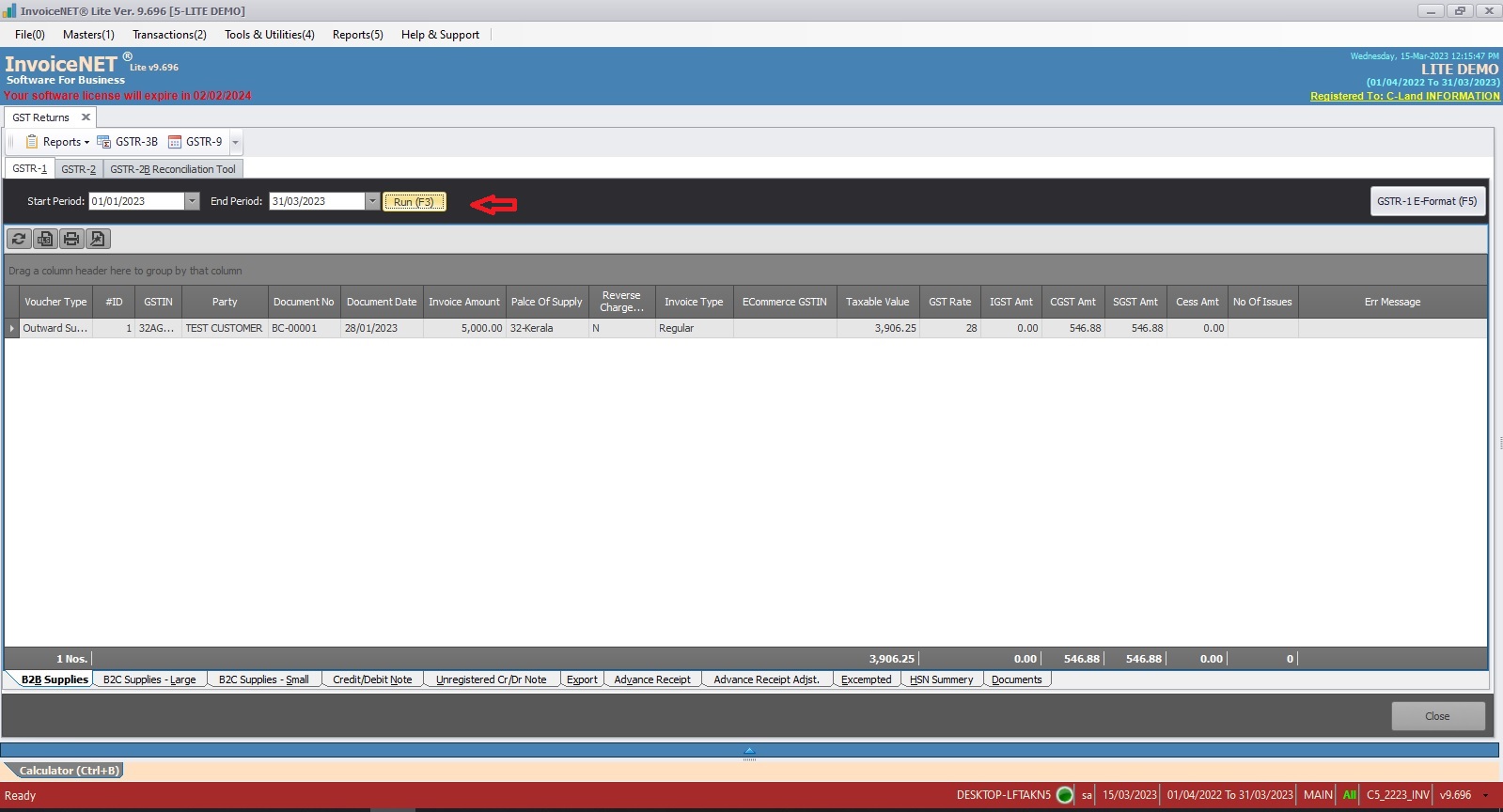

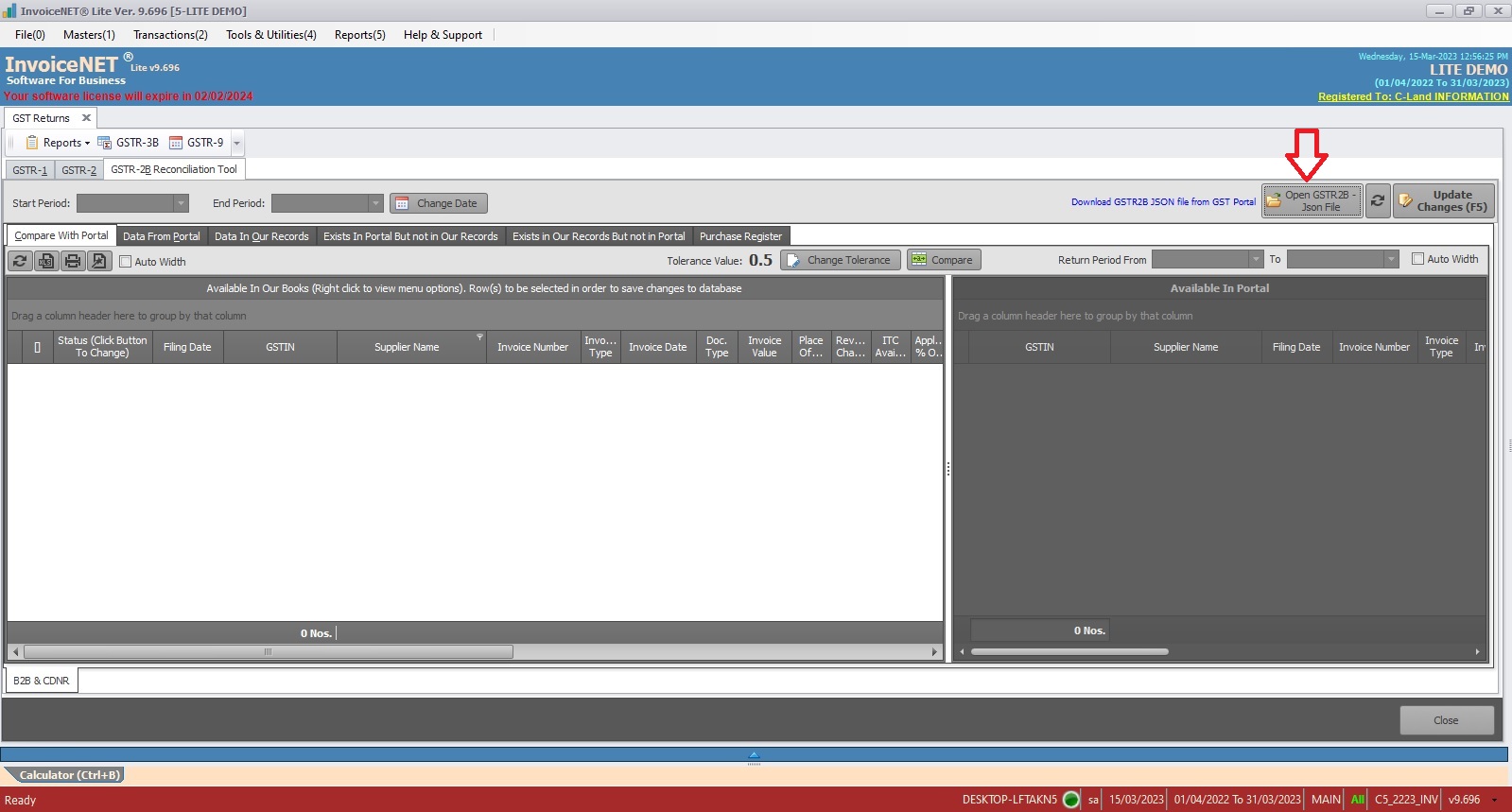

Step 3

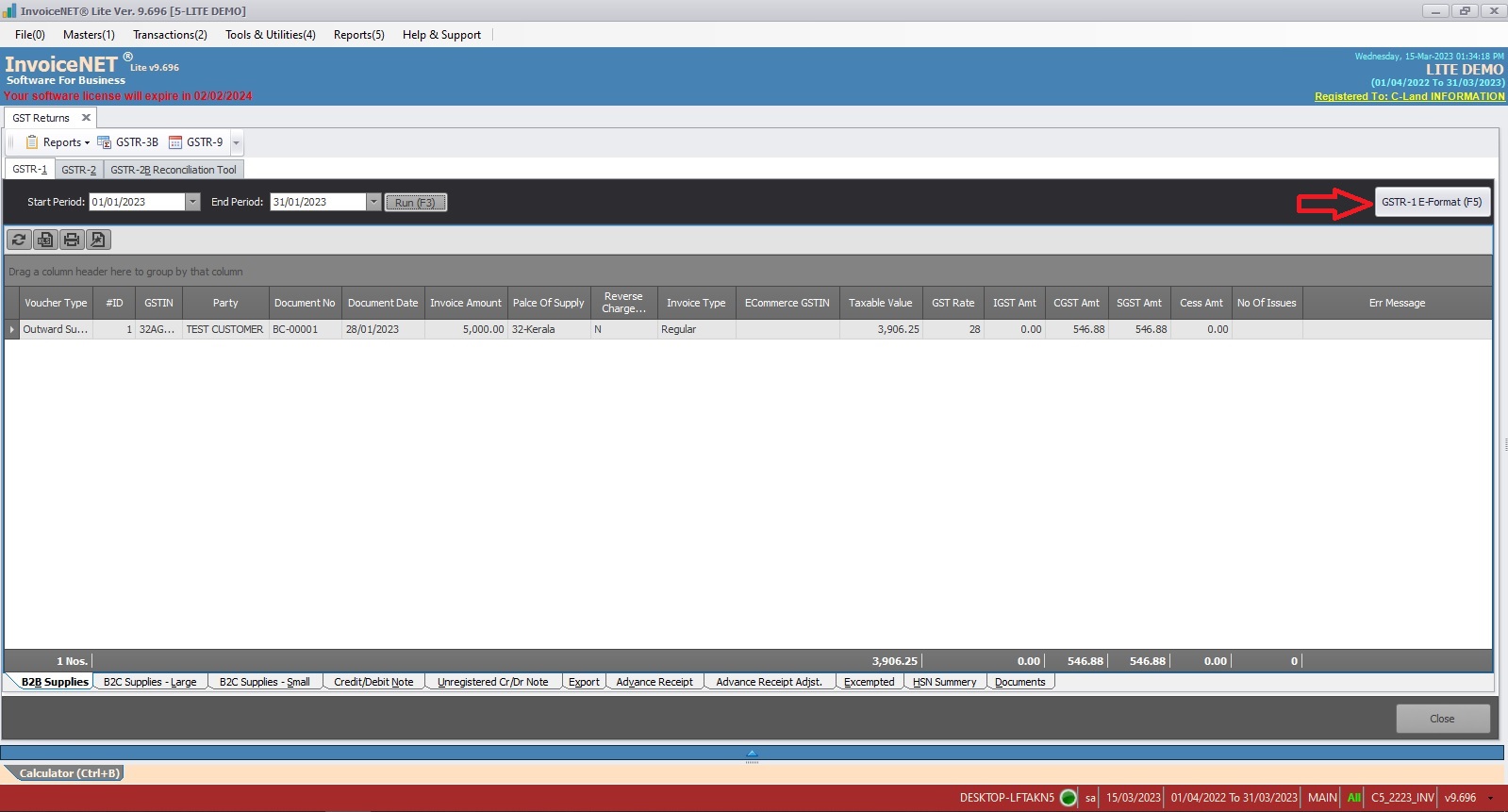

- Enter the period of the report and then click on the run button to view the report as shown in step 3 figure

Step 4

- For GSTR-2B reconciliation, download GSTR-2B JSON file from GST Portal and import it using Open GSTR2B Json File button as shown in step 4 figure

Step 5

- All GST Return formats can be exported to excel

- GSTR 3b & GSTR 9 will be exported to excel directly after entering a period

- GSTR-1 and GSTR-2 can be exported to excel by clicking the export button on the top right corner as shown in step 5 figure.