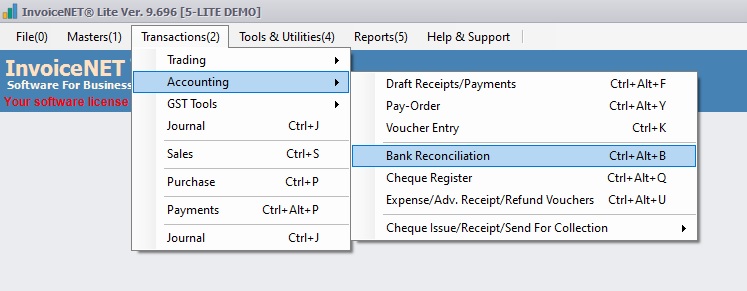

Transactions=>Accounting=>Bank Reconciliation

If a company has a bank account, should maintain a separate book for that a/c. All bank transactions should be posted to that book. These transaction details are also maintained by the bank. The closing balance as per our book must be tallied with the bank statement. InvoiceNET® Lite provides this facility through the Bank Reconciliation option of the Transaction menu. The Bank Reconciliation window shows all transaction voucher details of the bank. It can be tallied with bank statements only if Track Cheque No(s) property of the ledger is set to Yes.

- Step 1

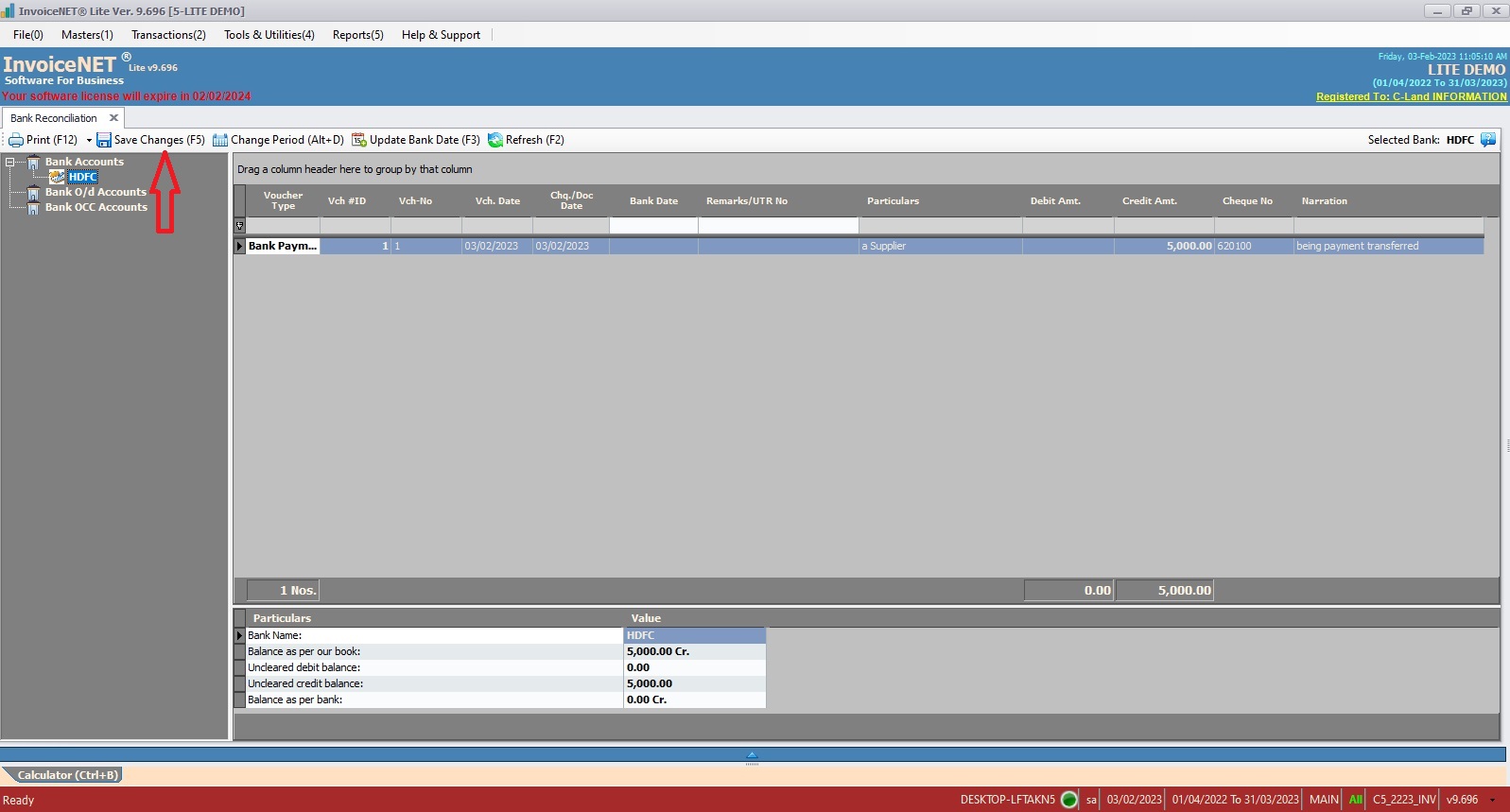

- Click Transactions=>Accounting=>Bank Reconciliation to view & update bank reconciliation as shown Step 1 figure

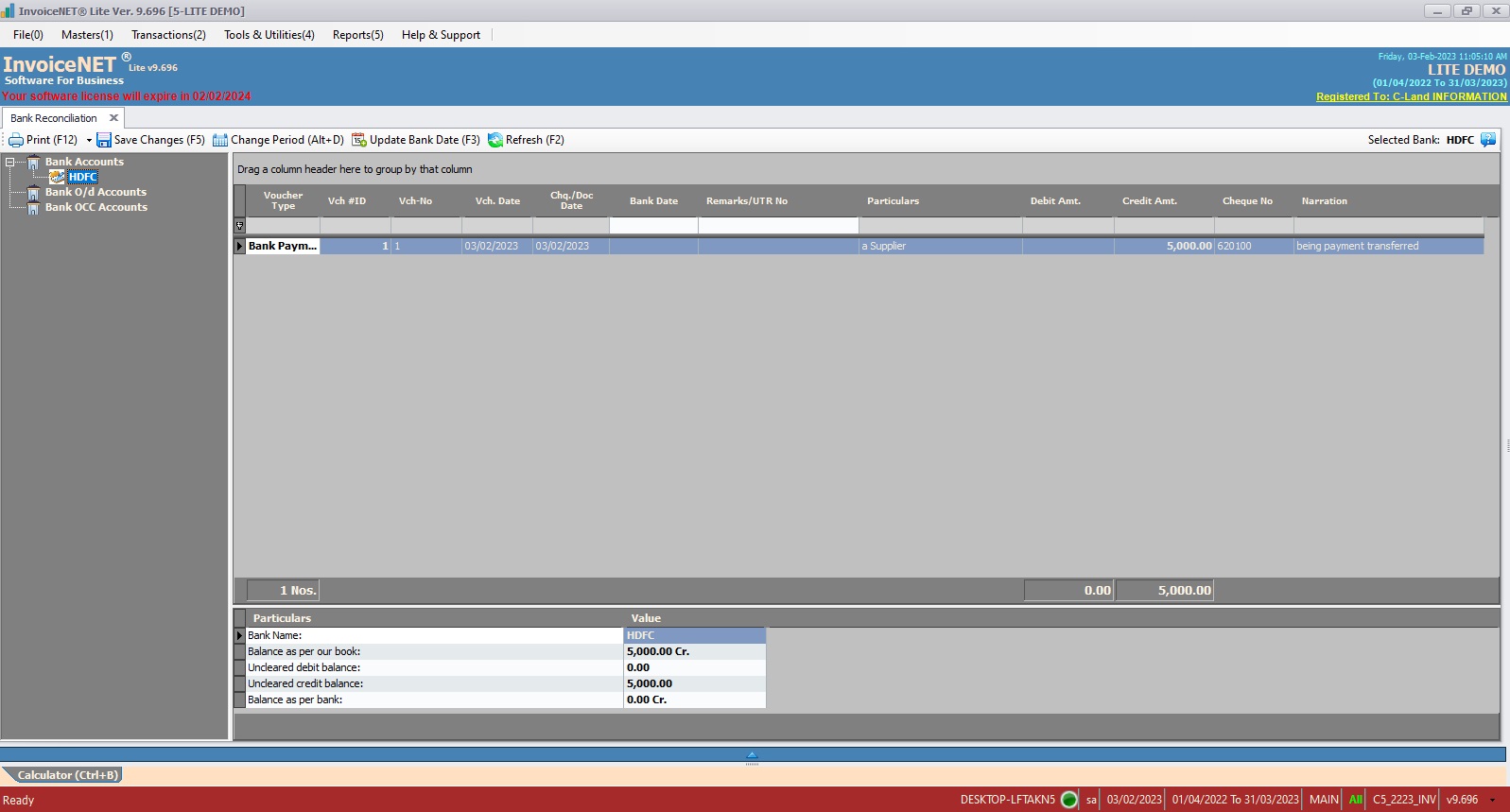

- Step 2

- Now Bank Reconciliation window appears as shown in the Step 2 figure.

- On the left panel of that window, the bank name should be selected. All vouchers details of the selected bank will be displayed on the right panel

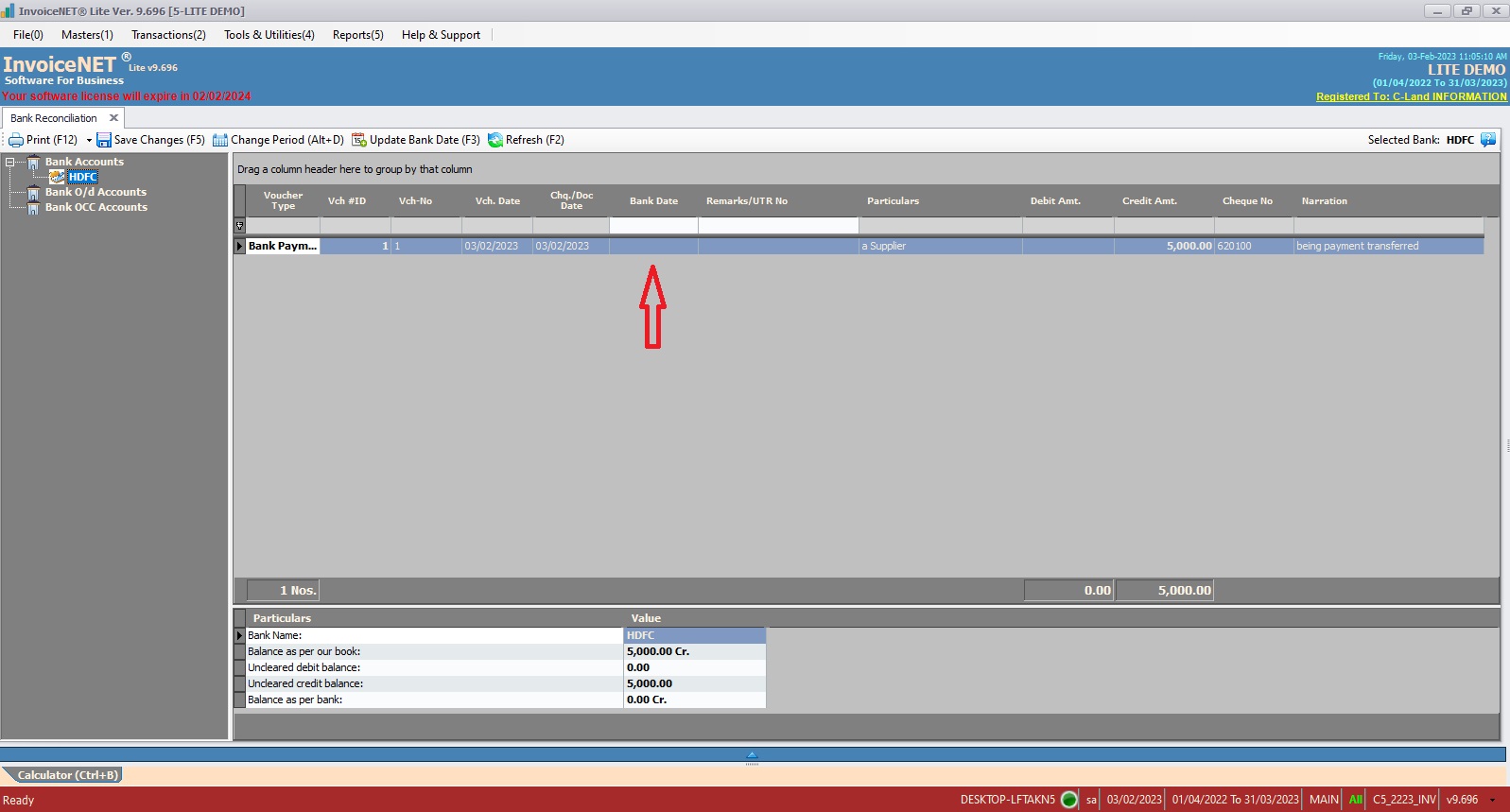

- Step 3

- Details that are available on the right panel are

- Voucher Type=> Type of the Transaction Voucher

- Vch #ID => Transaction Voucher ID

- Vch-No=> Transaction Voucher No

- Vch. Date => Transaction Date

- Chq. / Doc Date =>Cheque/ Other Document Date

- Bank Date => Date of Voucher specified in the bank statement

- Remarks/UTR No=> Any other remarks about that transaction/UTR No of the transaction

- Particulars => Party Name of the transaction voucher

- Debit Amount=>If the voucher type is a receipt, the amount is displayed here.

- Credit Amount=>If the voucher type is a payment, the amount is displayed here.

- Cheque No => Cheque No of the transaction

- Narration=>Narration of the voucher

- For reconciling, update the bank date and save the changes. Uncleared transaction details will be shown at the bottom panel