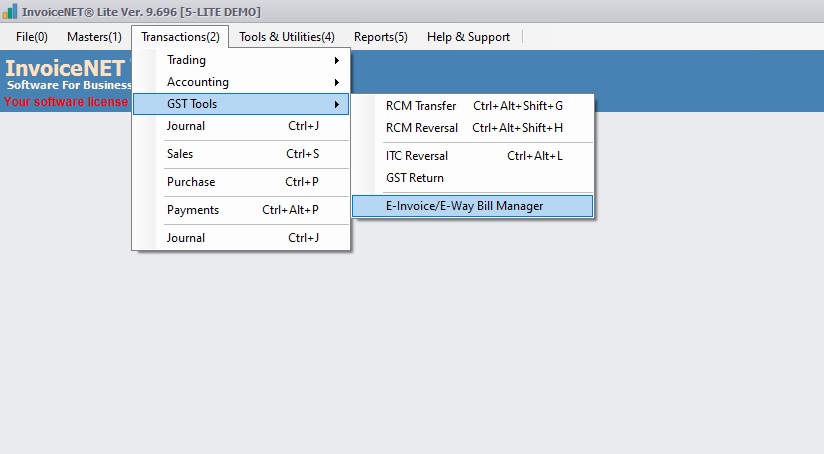

Transactions=>GST Tools=>E-Invoice / E-Way Bill Manager

E-Invoice is a system in which B2B invoices are authenticated electronically by GSTN for further use on the common GST portal. Under the electronic invoicing system, an identification number will be issued against every invoice by the Invoice Registration Portal (IRP) to be managed by the GST Network (GSTN). All invoice information is transferred from the einvoice1.gst.gov.in portal to both the GST portal and e-way bill portal in real time. As per the latest mandate, all businesses with a turnover exceeding 10 crores are required to generate e-invoices starting from 1st October 2022.

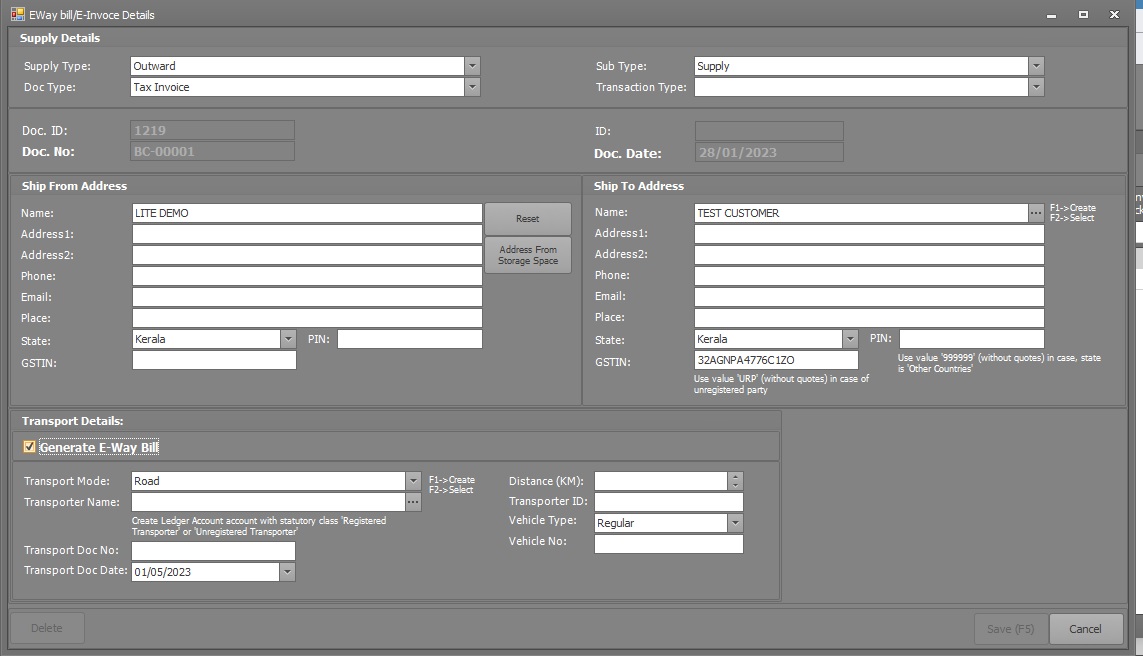

Electronic Way Bill (E-Way Bill) is basically a compliance mechanism wherein by way of a digital interface the person causing the movement of goods uploads the relevant information prior to the commencement of the movement of goods and generates an e-way bill on the GST portal. e-way bill is a document required to be carried by a person in charge of the conveyance carrying any consignment of goods of value exceeding fifty thousand rupees as mandated by the Government.

In InvoiceNET® Lite , E-Invoice / E-way Bill Manager tool helps to generate & handle E-Invoice / E-Way Bill efficiently & easily.

Step 1

- Click Transactions=>GST Tools=>E-Invoice/E-Way Bill Manager to generate E-Invoice/E-Way Bill as shown in Step 1 figure

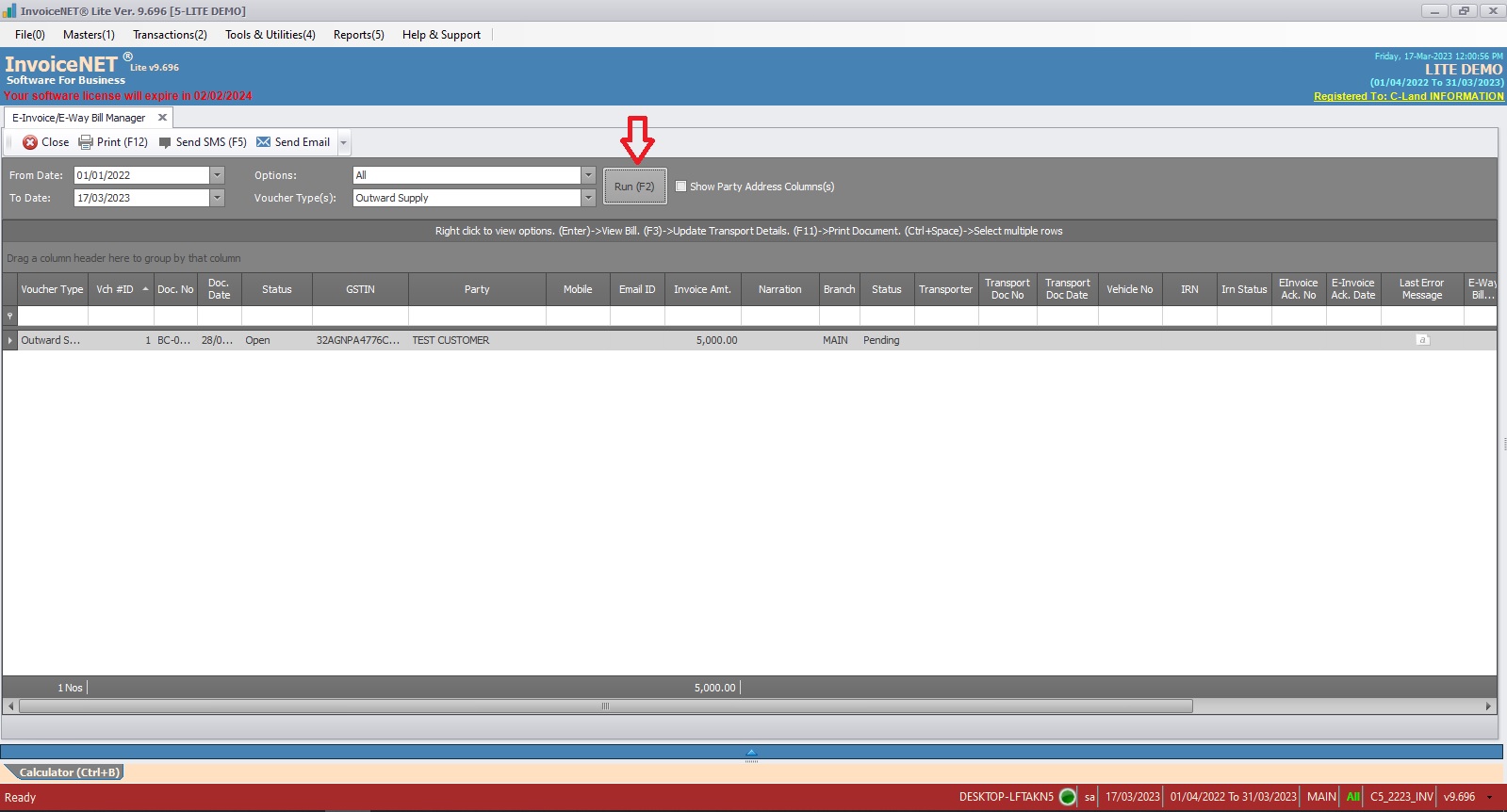

- E-Invoice/E-Way Bill Manager window will appear as shown in Step 2 figure

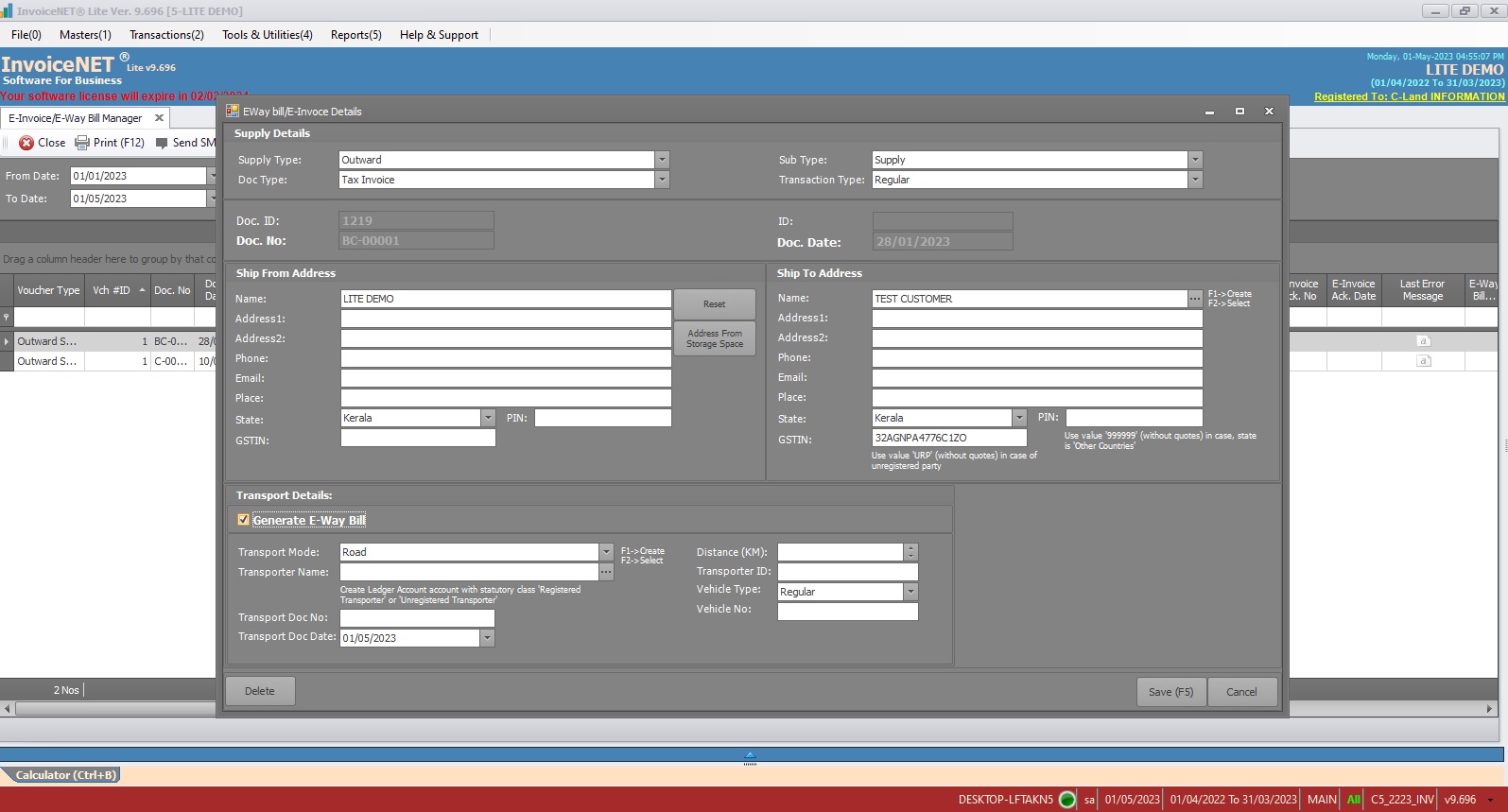

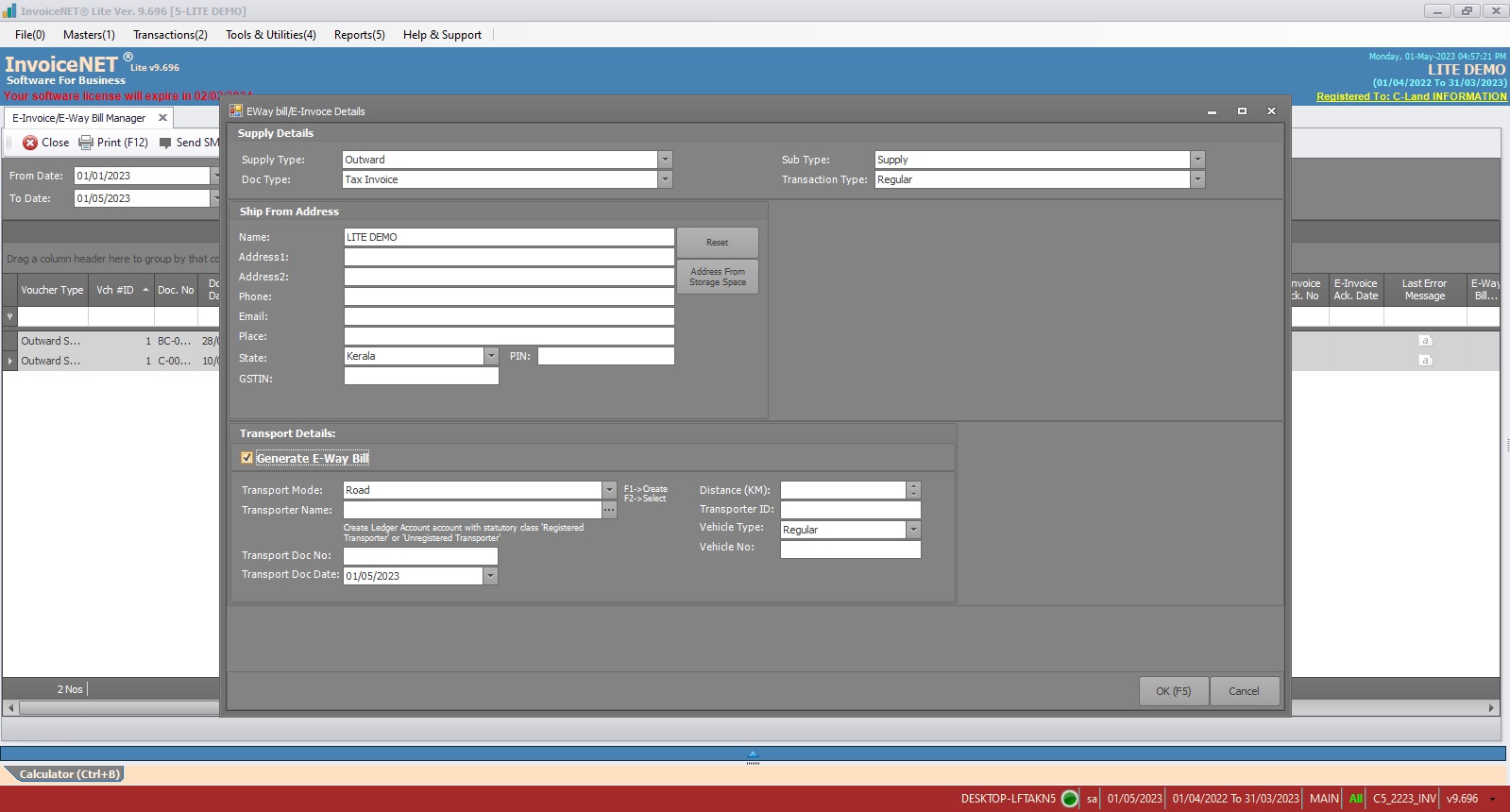

- On that window, filter transactions for E-invoice by filling in the following

- From Date=>Starting Date of Search Period

- To Date=>Ending Date of Search Period

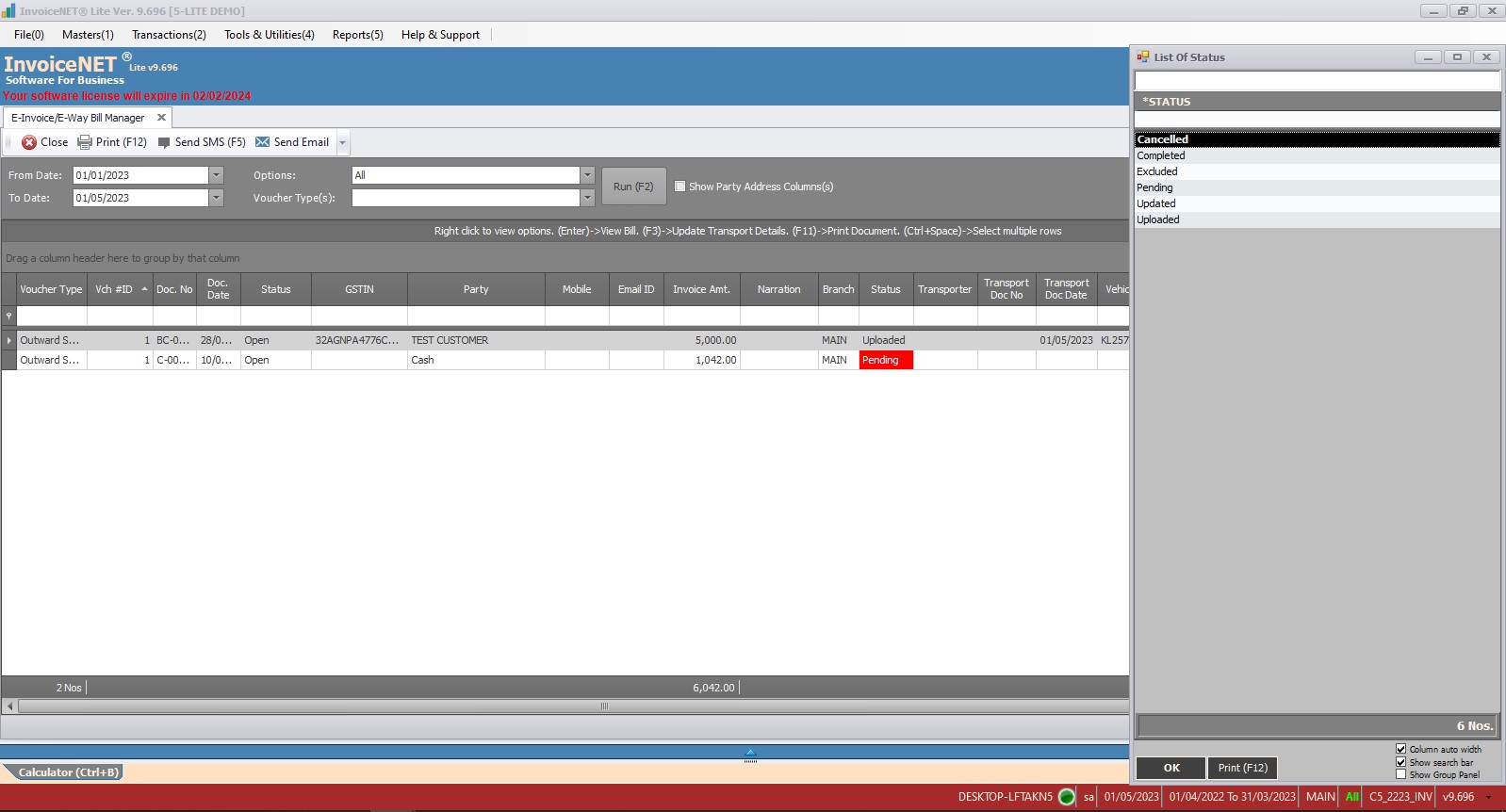

- Options=> There are several filtering options available to select in this combo box. Select any of them. Available options are

- All

- Has Eway bill no

- Pending with Invoice Value>=50000

- Pending with Invoice ValueTaxable>=50000

- Pending

- Cancelled

- Excluded

- Updated

- Uploaded

- Voucher Type(s)=>Vouchertype to filter transactions. Multiple vouchertypes can be selected

- Show Party Address Columns(s)-Tick if party address details are needed

- After filling above options, click on Run(F2) button to apply

- As soon as the run button is clicked, the transactions are listed as per the criteria as shown in Step 3 figure

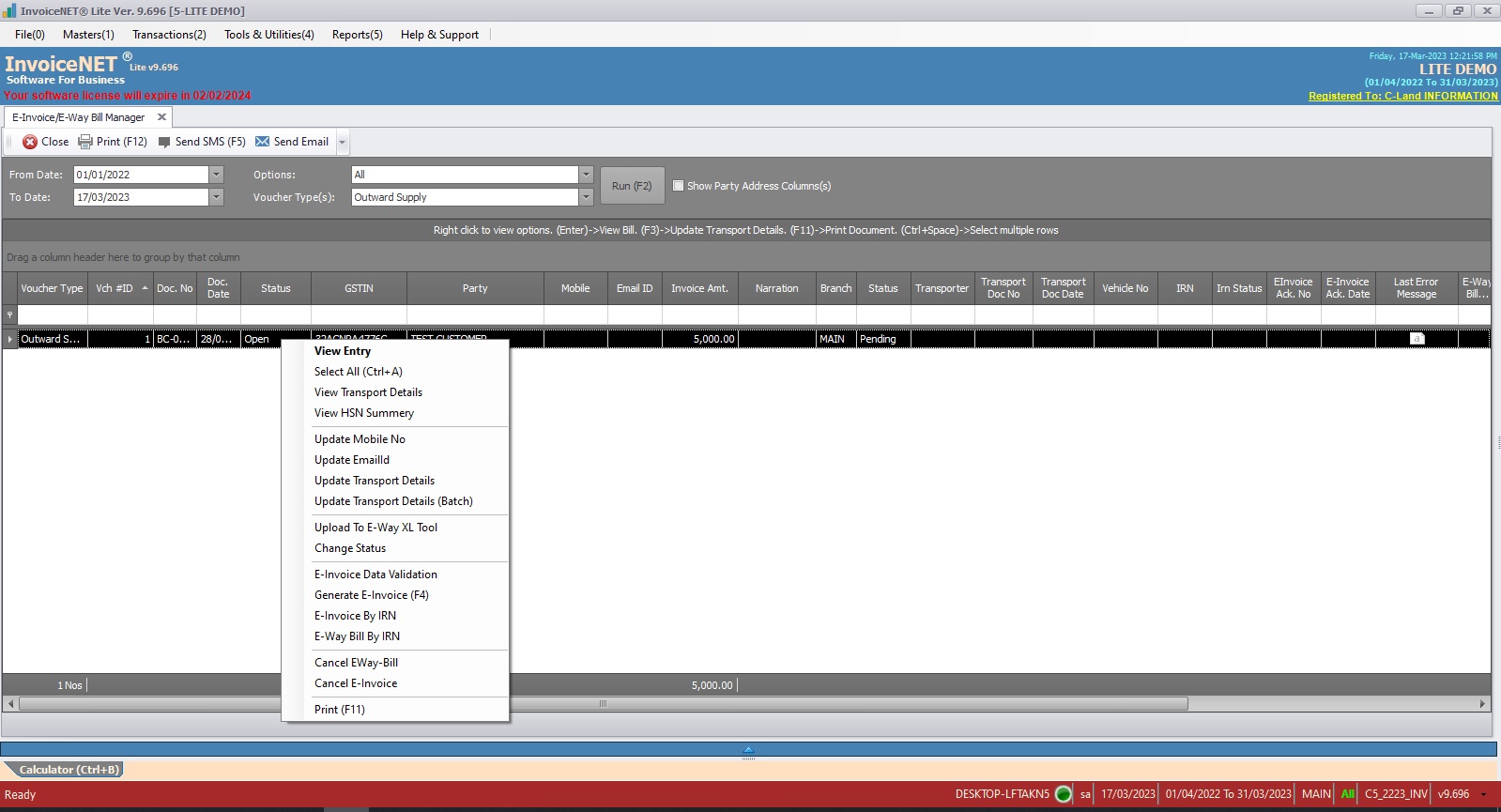

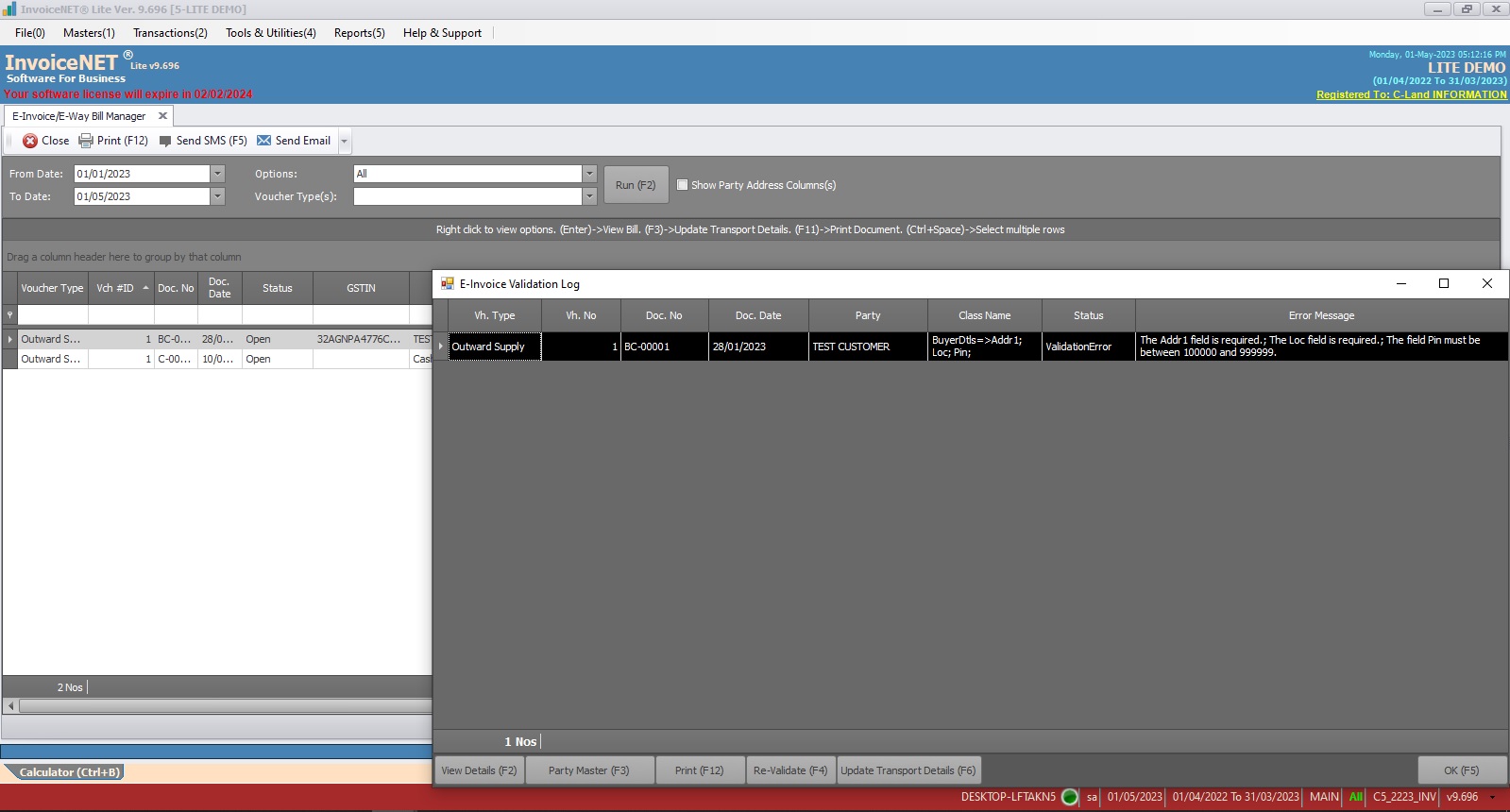

- While right-clicking on each transaction, a pop-up box appears as shown in Step 4 figure. Available options are

- View Entry => To View details of the selected transaction

- Select All (Ctrl + A)=>To select all transactions

- View Transport Details=>To view transport details of the selected transaction

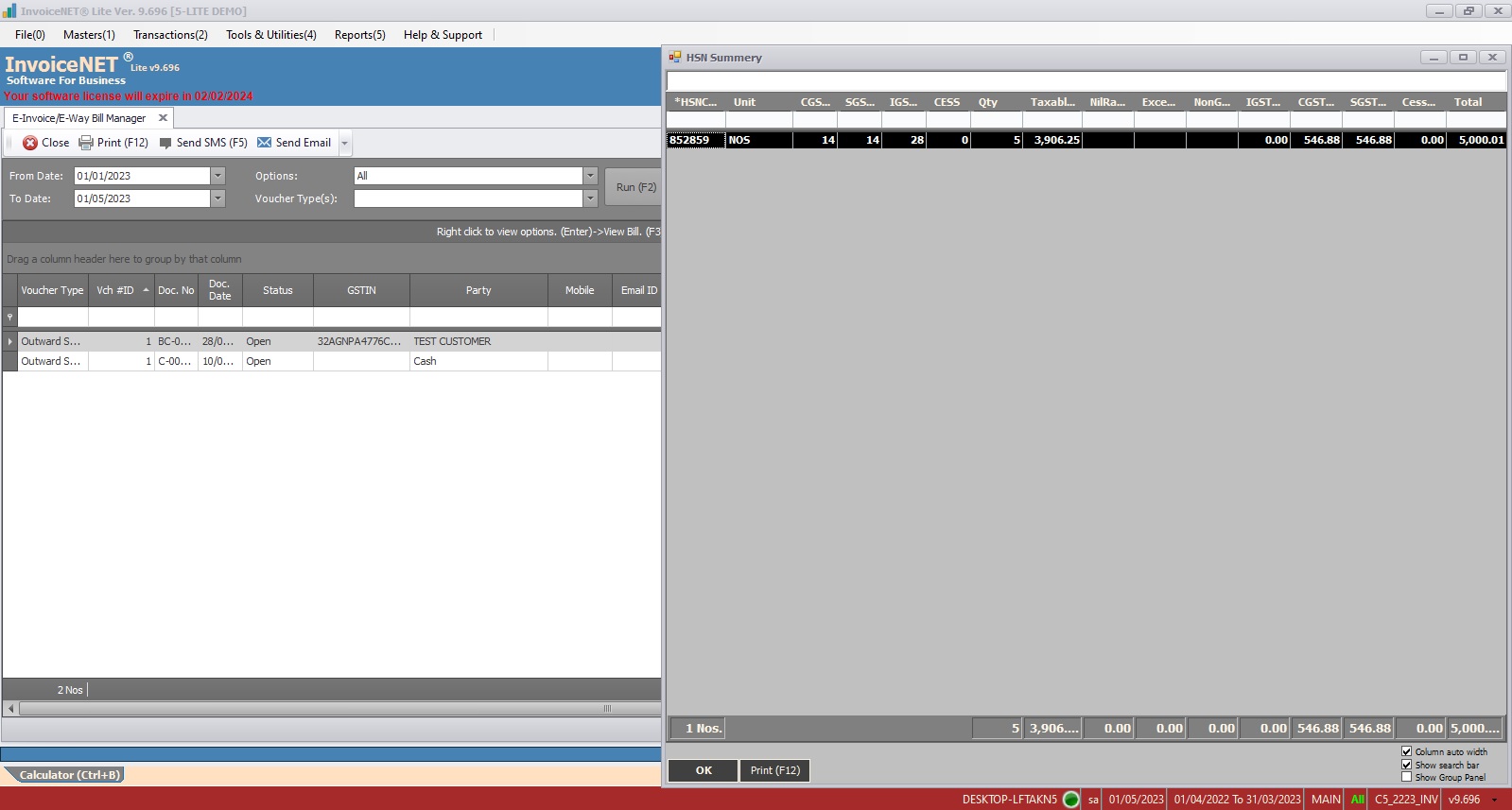

- View HSN Summary=>To view hsn summary details of the selected transaction

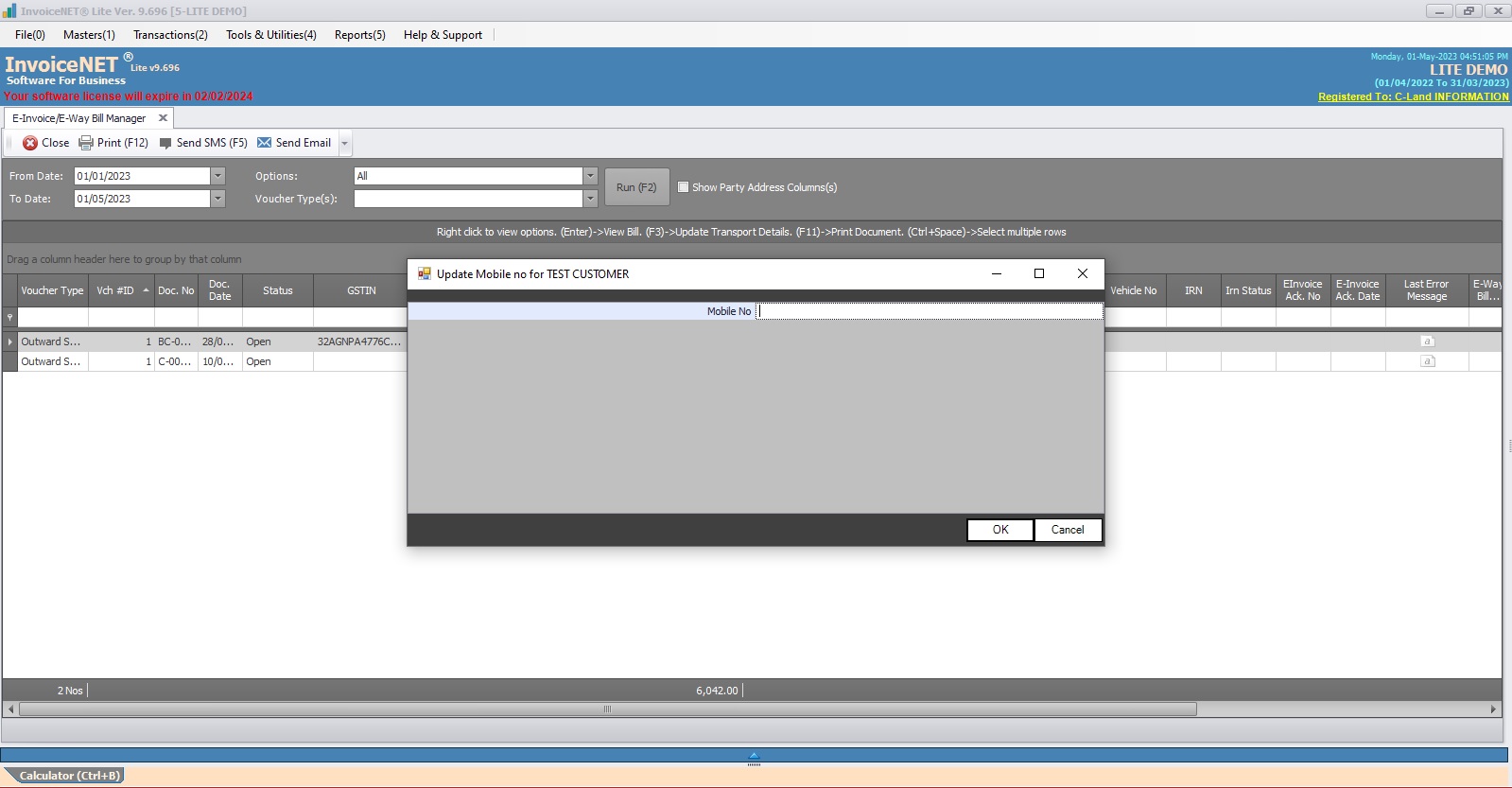

- Update Mobile No=>To update the mobile no of the party of the selected transaction

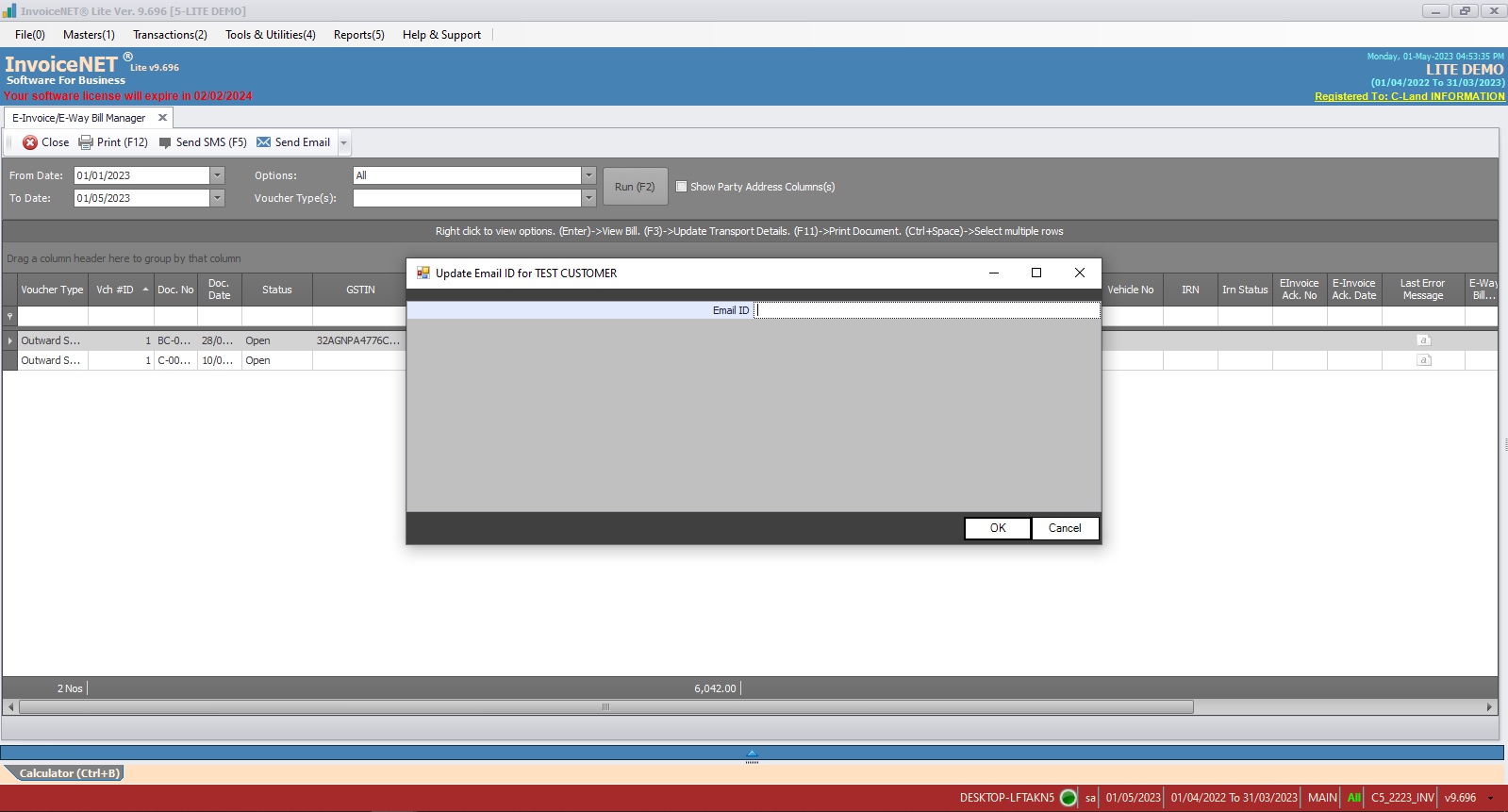

- Update Emailid=>To update the emailid of the party of the selected transaction

- Update Transport Details=>To update transport details of the single selected transaction

- Update Transport Details (Batch)=>To update transport details of multiple selected transactions

- Upload To E-way XL Tool-To generate e-Way bill only for the selected transactions

- Change Status – To change the status of the selected transaction before generate E-Invoice

- E-Invoice Data Validation – To validate updated e-invoice details of the selected transaction

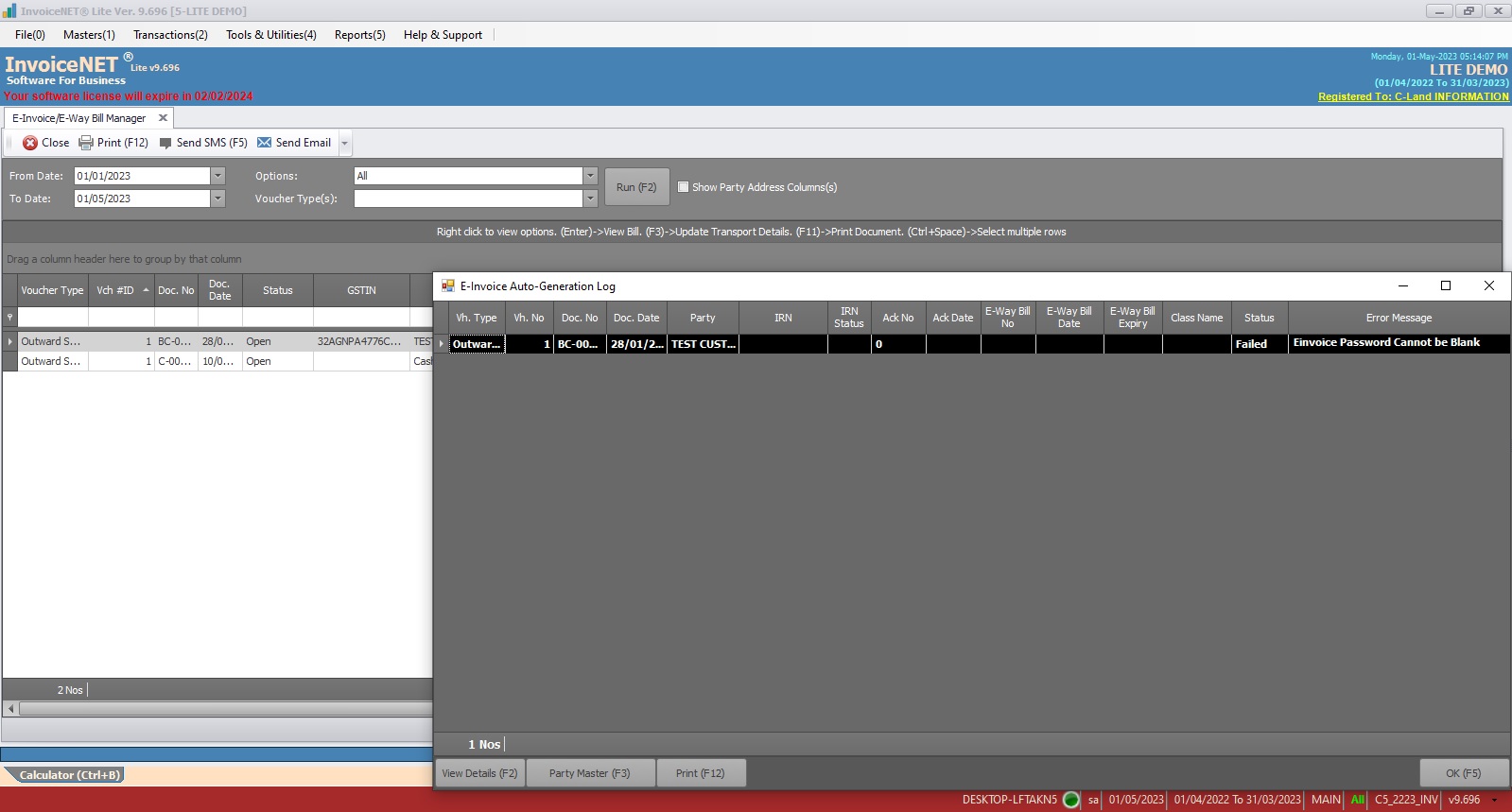

- Generate E-Invoice (F4) – To generate E-invoice for the selected transaction

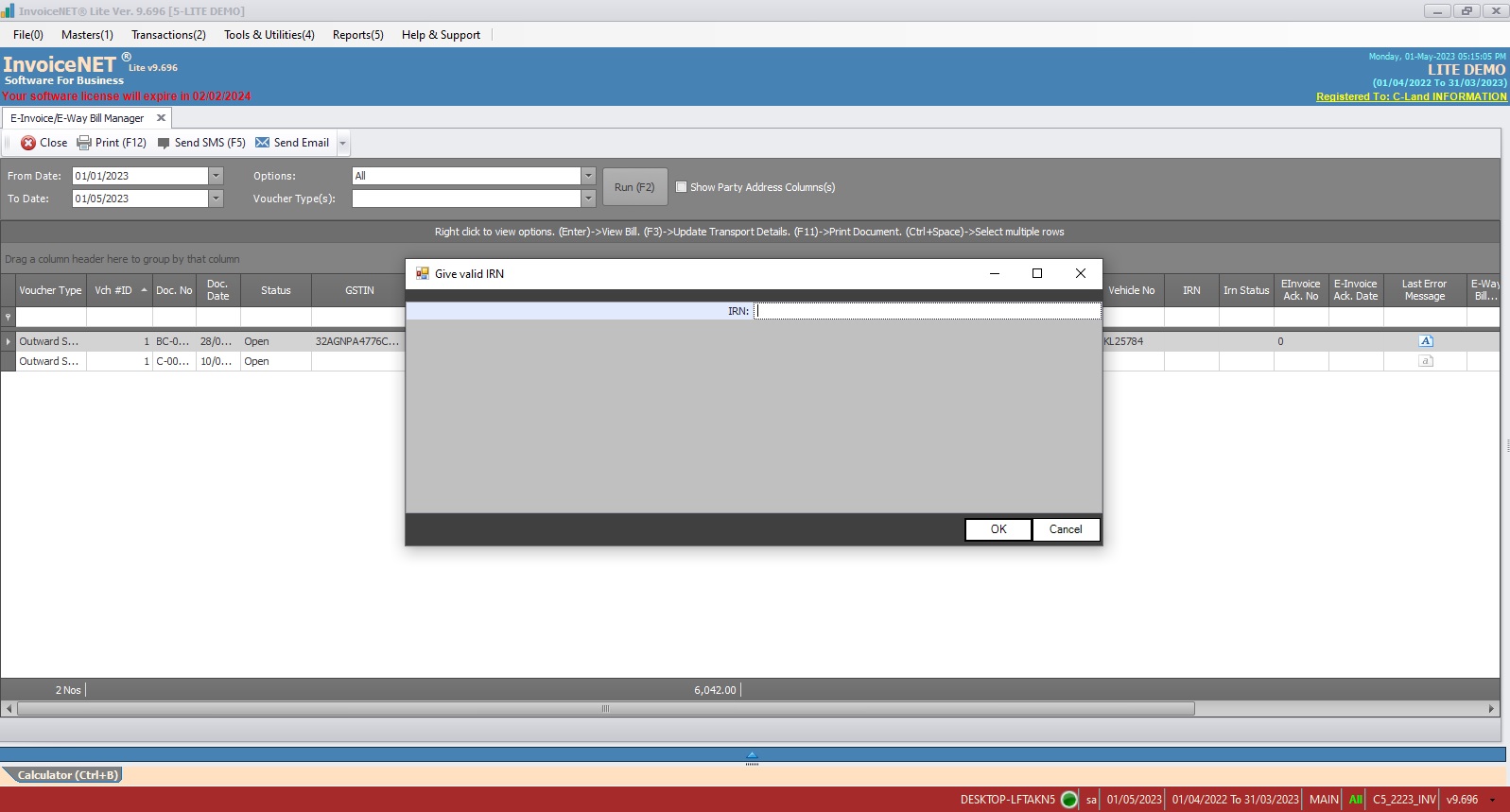

- E-Invoice By IRN-To search E-invoice By IRN Number

- E-Way Bill By IRN-To search E-way bill by IRN Number

- Cancel E-Way Bill – To cancel E-Way Bill of the selected transaction

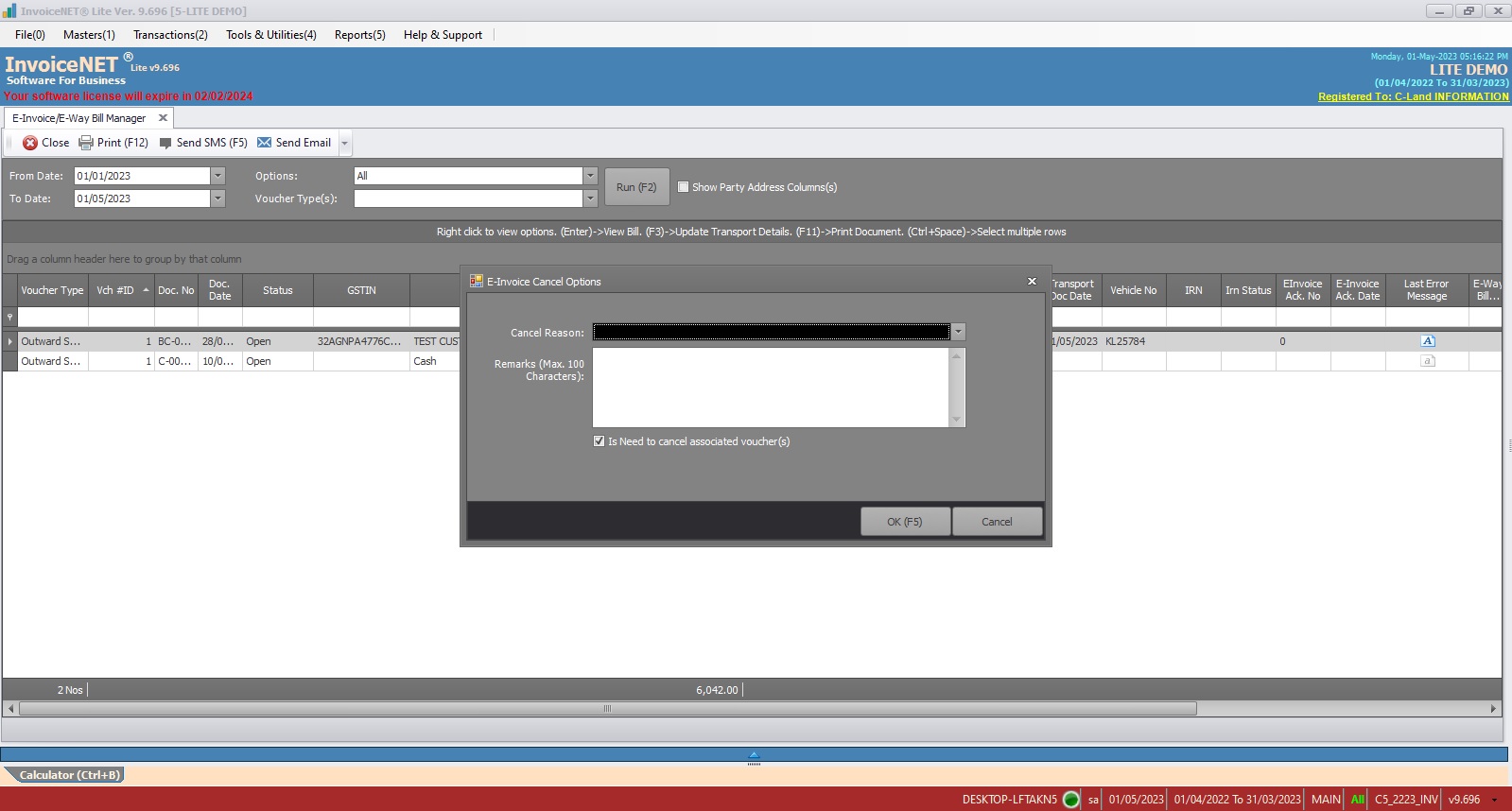

- Cancel E-Invoice- To cancel the selected transaction & its E-invoice

- Print (F11)- To print the selected transaction

See Also

-

- Product Creation