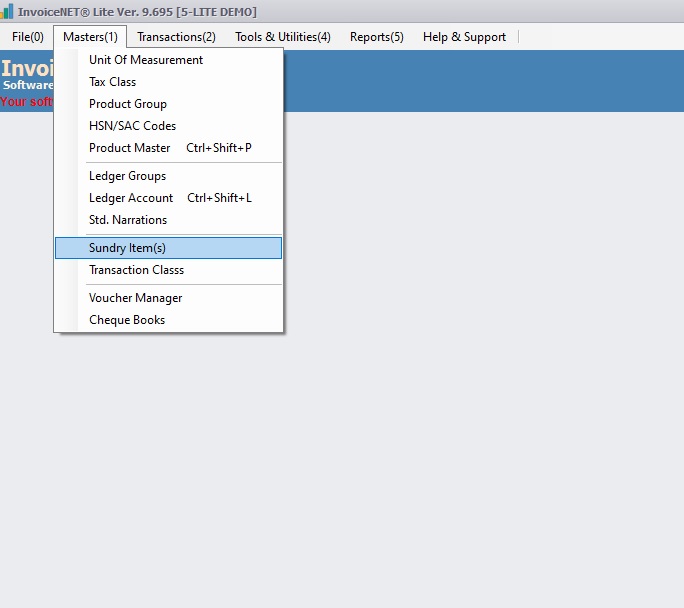

Masters=>Sundry Item(s)

Sundries are formula elements binding the ledger accounts and formula values which can be added with or subtracted from transaction values of vouchers; especially for inventory transactions. Sundries can form as members of a Transaction Class in the Auto Sundry Definition section or they can be selected individually in a voucher from the Sundries section.

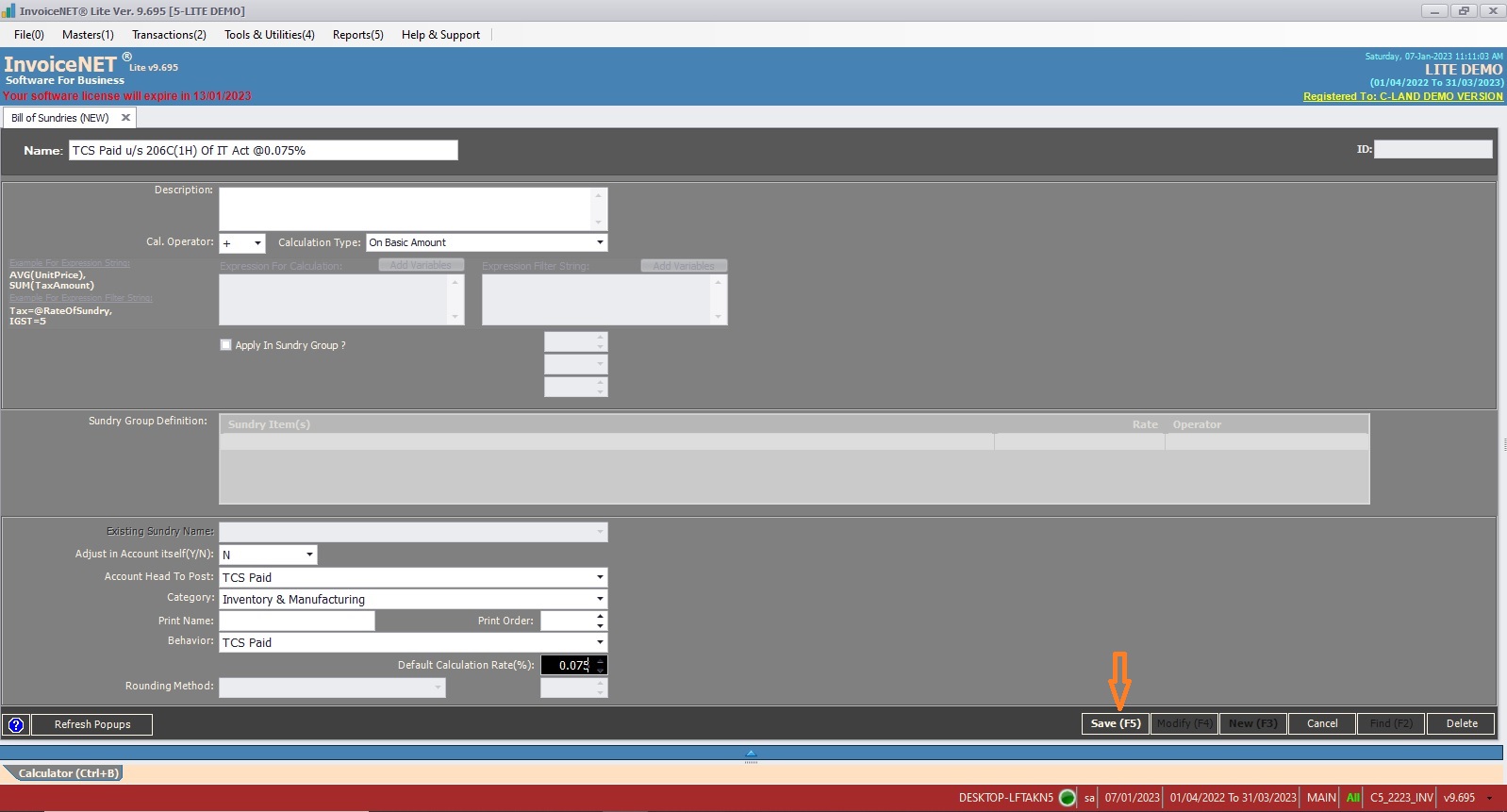

Example:

TCS Paid u/s 206C(1H) Of IT Act @0.075%

Parameter Values

Acc. Head to post: TCS Paid

Type: +

Operation: +

Calculation Type: On Basic Amount

By setting the above parameter values applied in an inventory transaction, the sundry, TCS Paid u/s 206C(1H) Of IT Act @0.075%, calculates 0.075% on basic amount and is added to the basic transaction value.

- Step 1

- Click Masters=>Sundry Item(s) to create, modify or delete sundry item as shown Step 1 figure

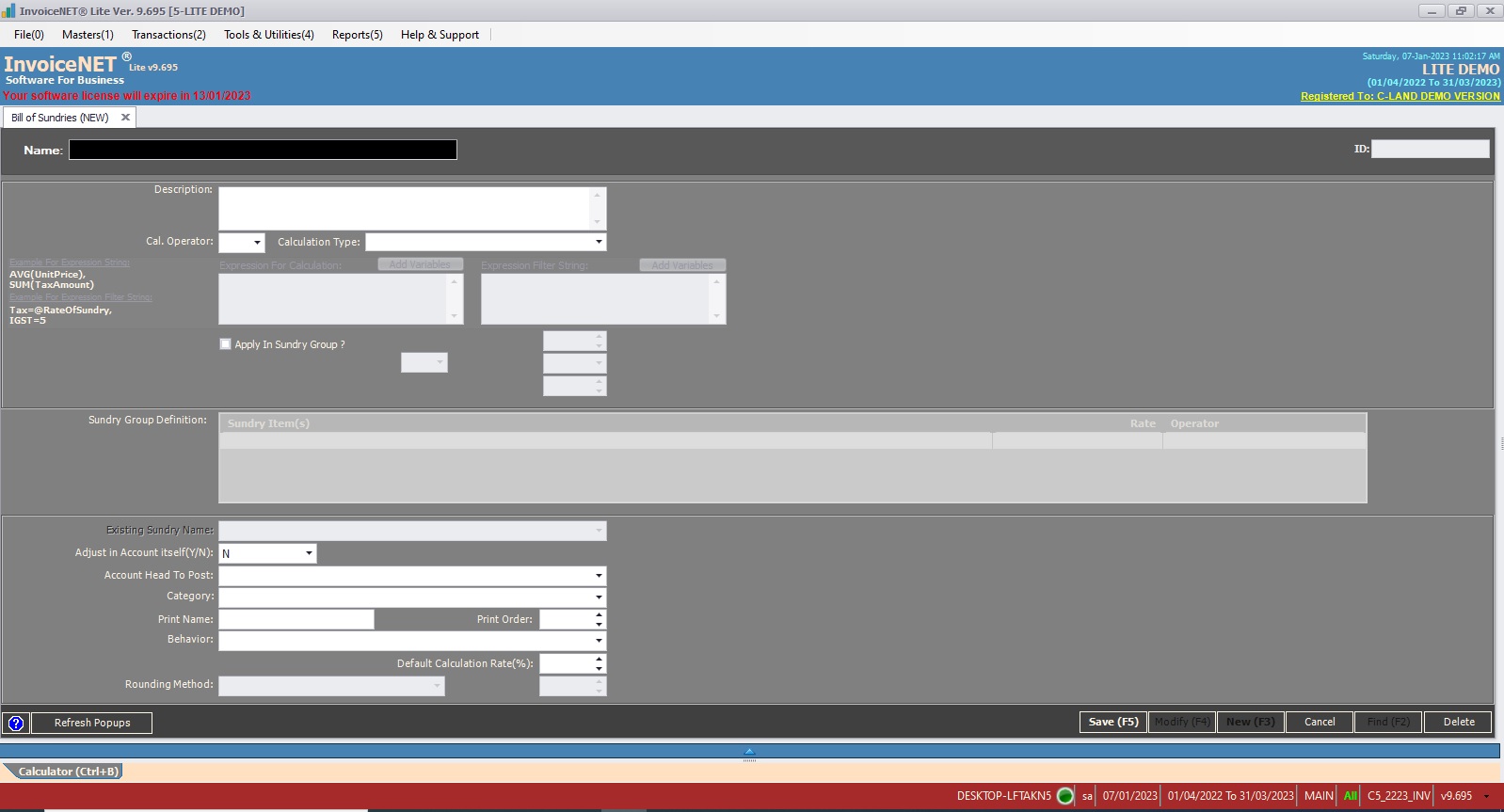

- Step 2

- Now sundry item creation window is appeared as shown in Step 2 figure

- Step 3

- User have to fill the text boxes as shown in Step 3 figure

- Name=> Name of sundry. Duplicate entries must be avoided.

- Description=> Enter description of sundry here if any

- Cal. Operator=>Type of Operation performed while sundry calculation. + indicates addition. – indicates subtraction.

- Calculation Type=>It specifies transaction value of vouchers which involves on sundry calculation. Select any one of available options. User can set custom calculation expression.

- Apply In Sundry Group?=>Set ‘Y’ if calculation is need to apply on sundries. Otherwise Set ‘N’

- Sundry Group Definition=>If ‘Apply In Sundry Group’ is set to ‘Y’, select sundry name here to apply calculation

- Adjust in Account itself (Y/N)=> If it has the value Y, calculated sundry value is adjusted in account (purchase or sales) itself. Otherwise it needs separate account.

- Account Head To Post=>If Adjust in Account Itself property is set to N, an account name for posting sundry values should be specified.

- Category=>Category of sundry. Print Name of sundry. Available options are Exclude In Sales Value/General/ Include In Sales Value/Others/Paying System/Service/ Stock Transfer

- Print Name=>Print Name of sundry. It is Optional

- Print Order=>Print position number. It is optional

- Behavior=>Behavior type of sundry. press space bar to select. Available options are Cess/CGST/CST/Discount/Edn. Cess/Educational Cess/Excise Duty/Expenses/ IGST/Income/Nothing/Others/Rounding/Service Tax/SGST/TCS Collected/TCS Paid/ VAT

- Default Calculation Rate (%)=>Enter default rate of sundry

- Rounding Method=>If ‘Behavior’ is set to ‘Rounding’, select rounding method here. Available options are Downward Rounding/Normal Rounding/Not Applicable/Upward Rounding

- After filling above text boxes, need to click save button to create a new sundry item

- User have to fill the text boxes as shown in Step 3 figure