Masters=>Transaction Class

Transaction classes are members of a voucher where we can define the account heads to which the accounting values of a transaction to be posted. Transaction class can also hold Sundries as members. A transaction class can be member of multiple vouchers. We can select which transaction classes to be added as members of a voucher from Set Transaction Class command from Voucher Manager.

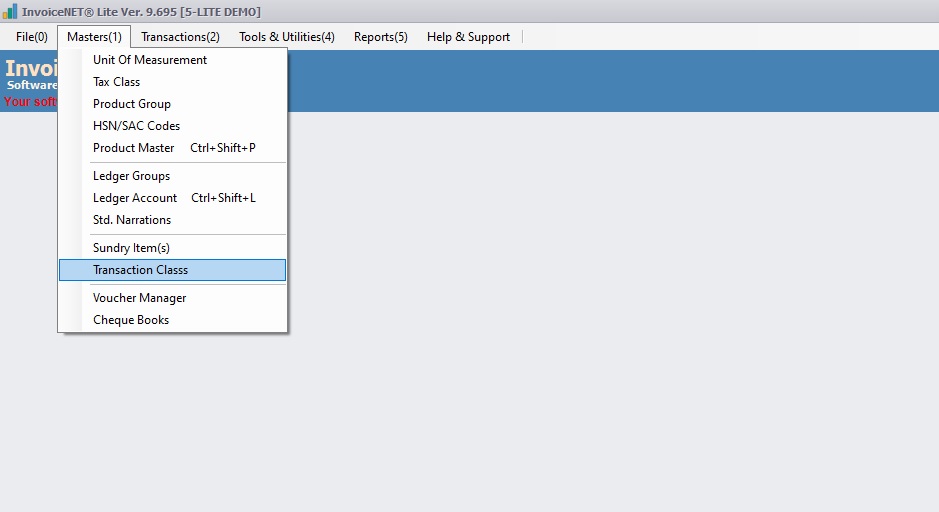

- Step 1

- Click Masters=>Transaction Class to create, modify or delete transaction class as shown in Step 1 figure

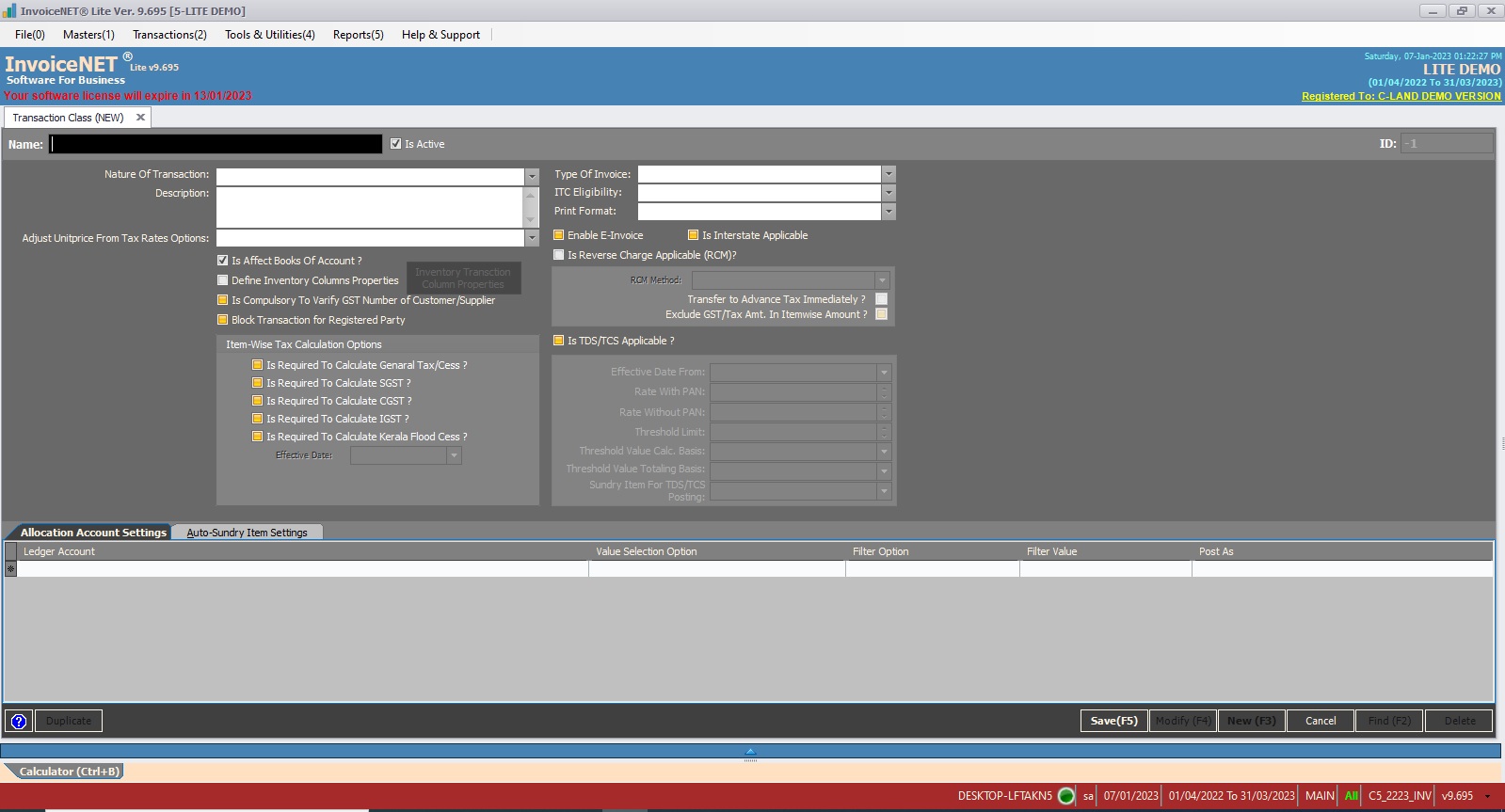

- Step 2

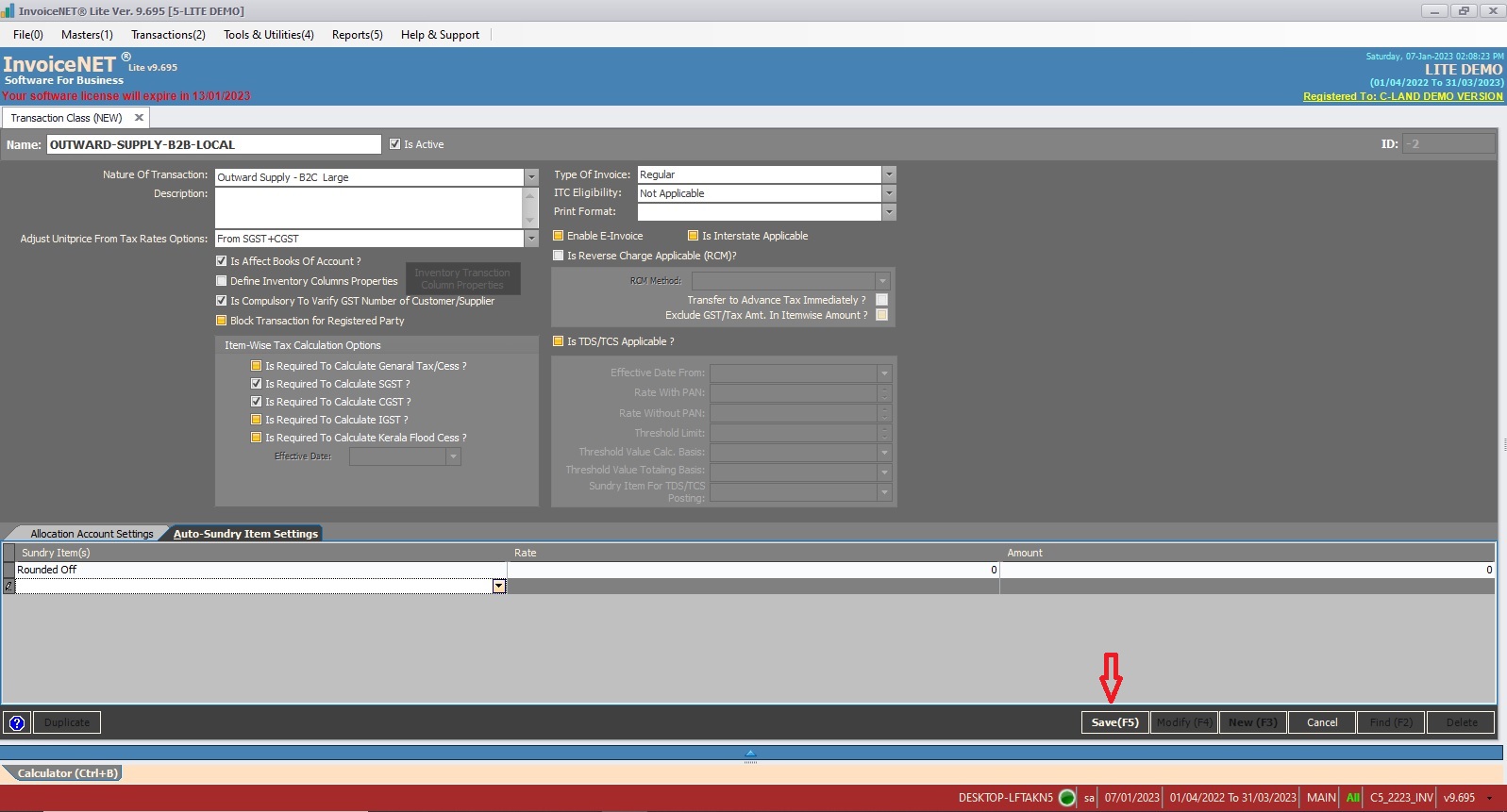

- Now Transaction Class creation window is appeared as shown in Step 2 figure

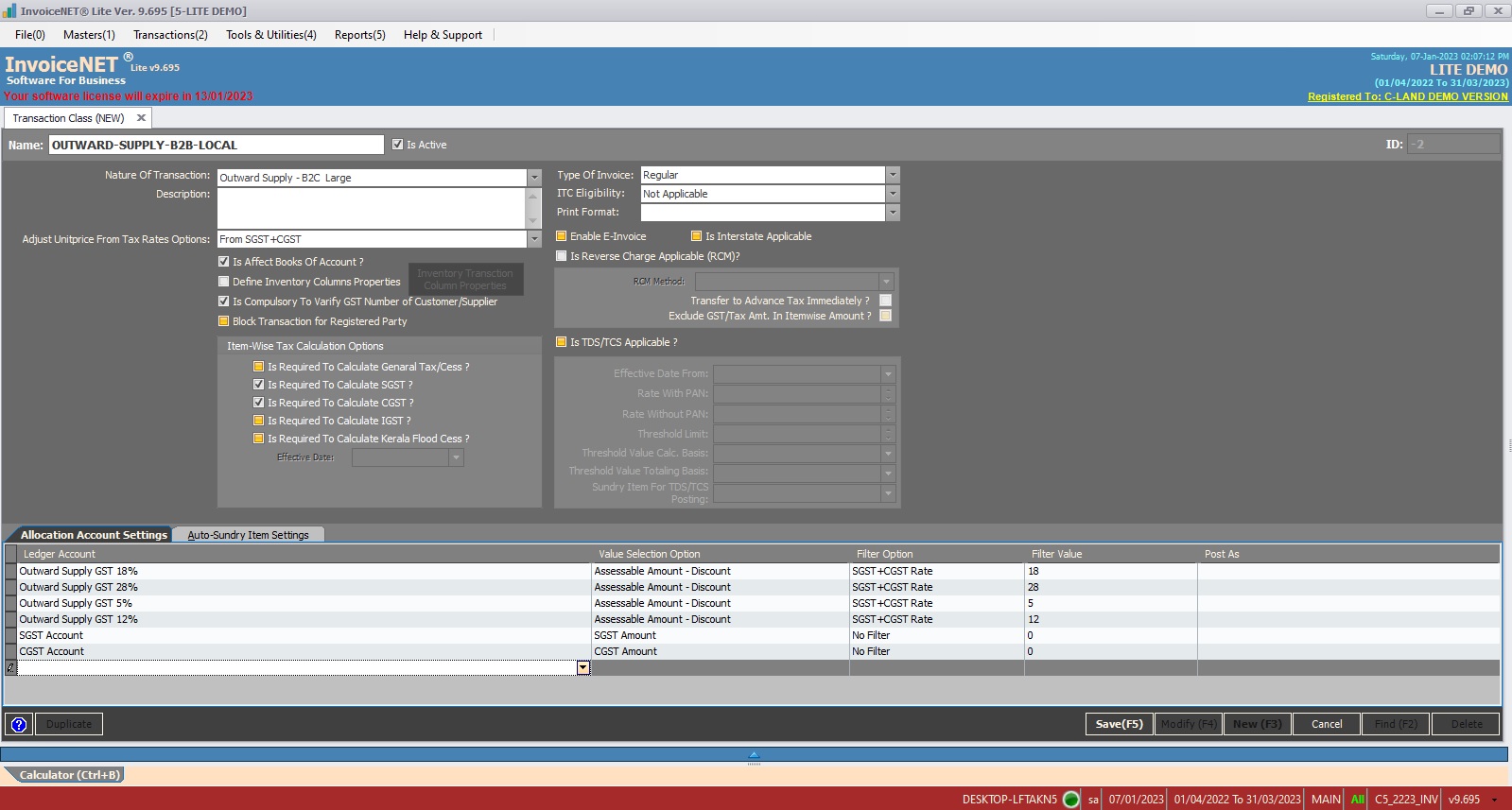

- Step 3

- User have to fill the text boxes as shown in Step 3(a),3(b) figures

- Name=>Name of the Transaction Class is specified here. Transaction Class Master does not allow duplicate names. Transaction Class name takes maximum 50 alpha numeric characters. Avoid single quotes (‘ or ’) in Transaction Class name.

- IsActive=> Enable/Disable this transaction class by tick / Untick

- Nature Of Transaction=>Select nature of this transaction class. Based on this, transaction will be shown in GST reports. Available options are

- NA-Not Applicable/b2cl-Outward Supply-B2C Large/ b2cs-Outward Supply B2C Small/exp-Export/at-Tax Liability On Advance/atadj-Advance Adjustments/ oth-Others/Rfnd-Advance Refund/txadj-Tax Adjustments/cn-Credit Note(Customers) / dn-Debit Note (Customers)/cnu-Credite Note Unregistered(Customers)/ dnu-Debit Note Unregistered(Customers)/b2binur-Inward Supply – Unregistered(RCM) /b2binr-Inward Supply -Registered(B2B)/b2bour-Outward Supply – Registered(B2B)/itcr-ITC Reversal/txpyt – Tax Payment/etc..

- Description=>Description is meant to store any detailed description of transaction class such as for what it is created.

- Adjust Unitprice From Tax Rates Options=> Select how to adjust tax rate on unit price. Available options are None/From Tax Rate/From SGST/From CGST/From IGST/From SGST+IGST/etc..

- Is Affect Books Of Account?=>Set ‘Y’ If this transaction class needs to affect books of account. Otherwise set ‘N’

- Define Inventory Column Properties=>Tick it if this transaction class needs a separate column properties

- Is Compulsory To Verify GST Number Of Customer/Supplier?=> Tick it if GST Number verification is compulsory for this transaction class

- Item -Wise Tax Calculation Options=>Tick any of below item wise tax calculation options suitable for the transaction class

- Is Required To Calculate General Tax/Cess?

- Is Required To Calculate SGST?

- Is Required To Calculate CGST?

- Is Required To Calculate IGST?

- Is Required To Calculate Kerala Flood Cess?

- Type Of Invoice=> Select Invoice Type here. It is optional. Available options are Regular/Export With Tax/Export Without Tax/E-Commerce/etc…

- ITC Eligibility=> Select ITC Eligibility of the transaction class. It is optional. Available options are Not Applicable/ Input Goods/Input Services/Capital Goods/etc…

- Print Format=>If this transaction class needs default print out automatically, assign the print format here. It is optional.

- Enable E-Invoice=> Tick if E-Invoice option required for this transaction class

- Is Interstate Applicable=> Tick if this transaction class belongs to interstate

- Is Reverse Charge Applicable(RCM)?=>Tick if this transaction class need reverse charge calculation. If it is ticked, you have to specify the below said properties of RCM

- ROM Method

- Transfer To Advance Tax Immediately?

- Exclude GST/Tax Amt. In Itemwise Amount?

- Is TDS/TCS Applicable?=>Tick if TDS/TCS is applicable for the transaction class. If it is ticked, you have to define the below said properties of TDS/TCS calculation

- Effective Date From * Threshold Value Calc. Basis

- Rate With PAN * Threshold Value Totaling Basis

- Rate Without PAN * Sundry Item For TDS/TCS

- Threshold Limit * Posting

- Allocation Account Settings=>If ‘Is Affect Books Of Account’ is ticked, you must specify posting ledgers here

- Auto-Sundry Item Settings => Specify auto sundry definition if any for this transaction class

- After filling above text boxes, need to click save button to create a new Transaction Class

- User have to fill the text boxes as shown in Step 3(a),3(b) figures