Common Accounting Voucher Type

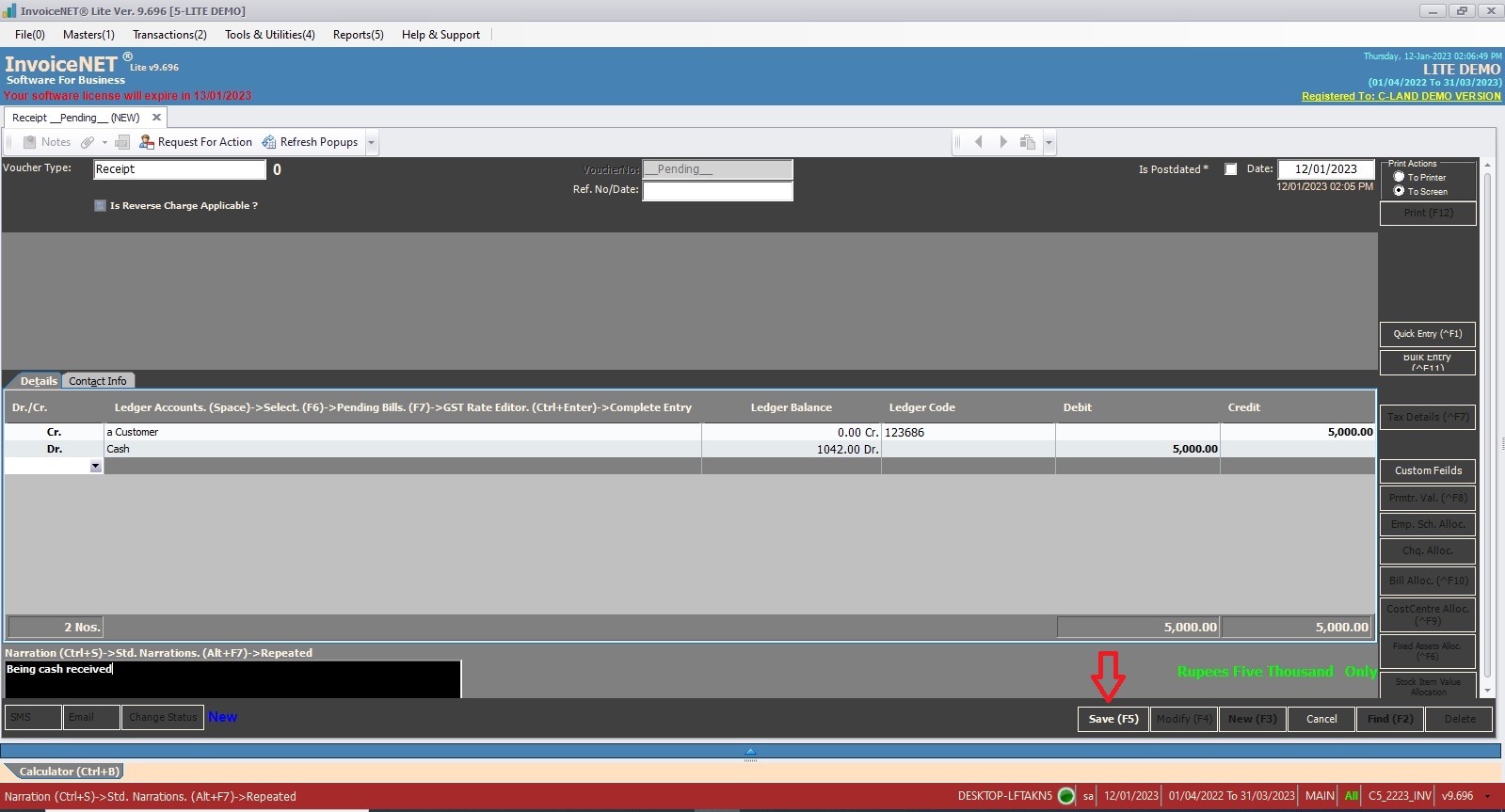

- Receipt=> Voucher entries recording cash received are entered in receipt vouchers. In receipt voucher entries, cash ledgers are debited and the ledgers from where the cash is received are credited.

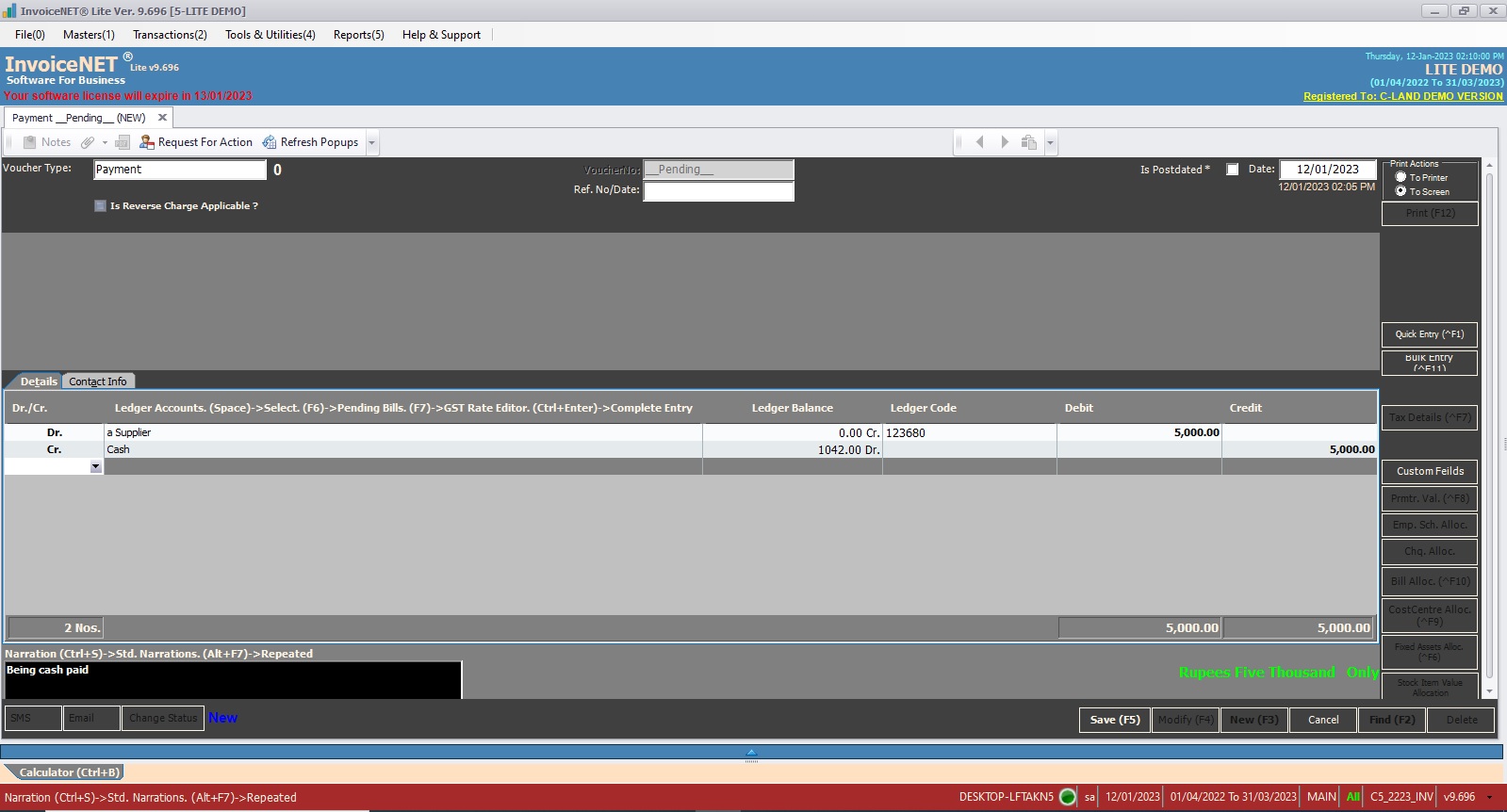

- Payment=> Voucher entries recording cash paid are entered in payment vouchers. In payment voucher entries, cash ledgers are credited and the ledgers to where the cash is paid are debited.

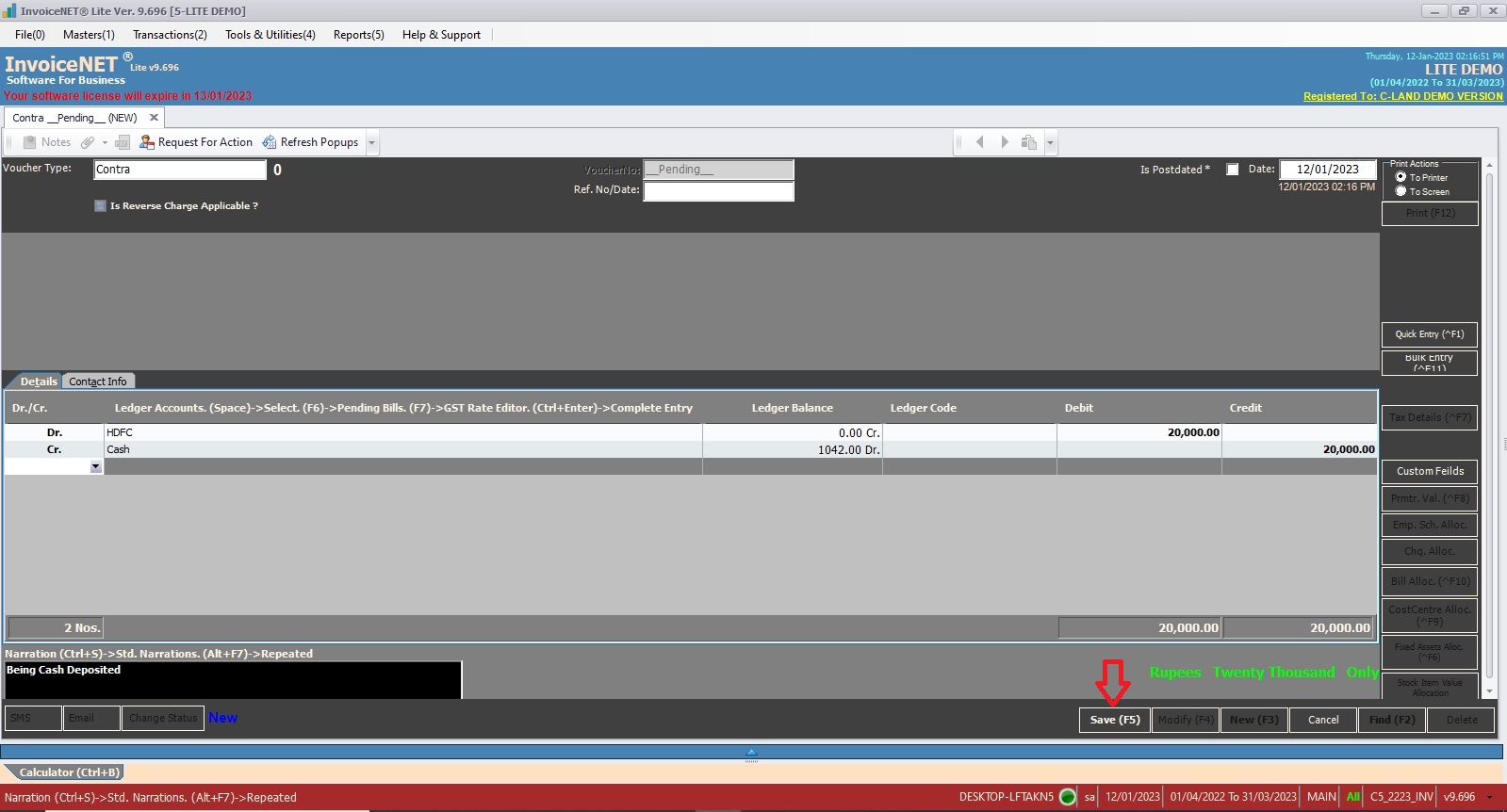

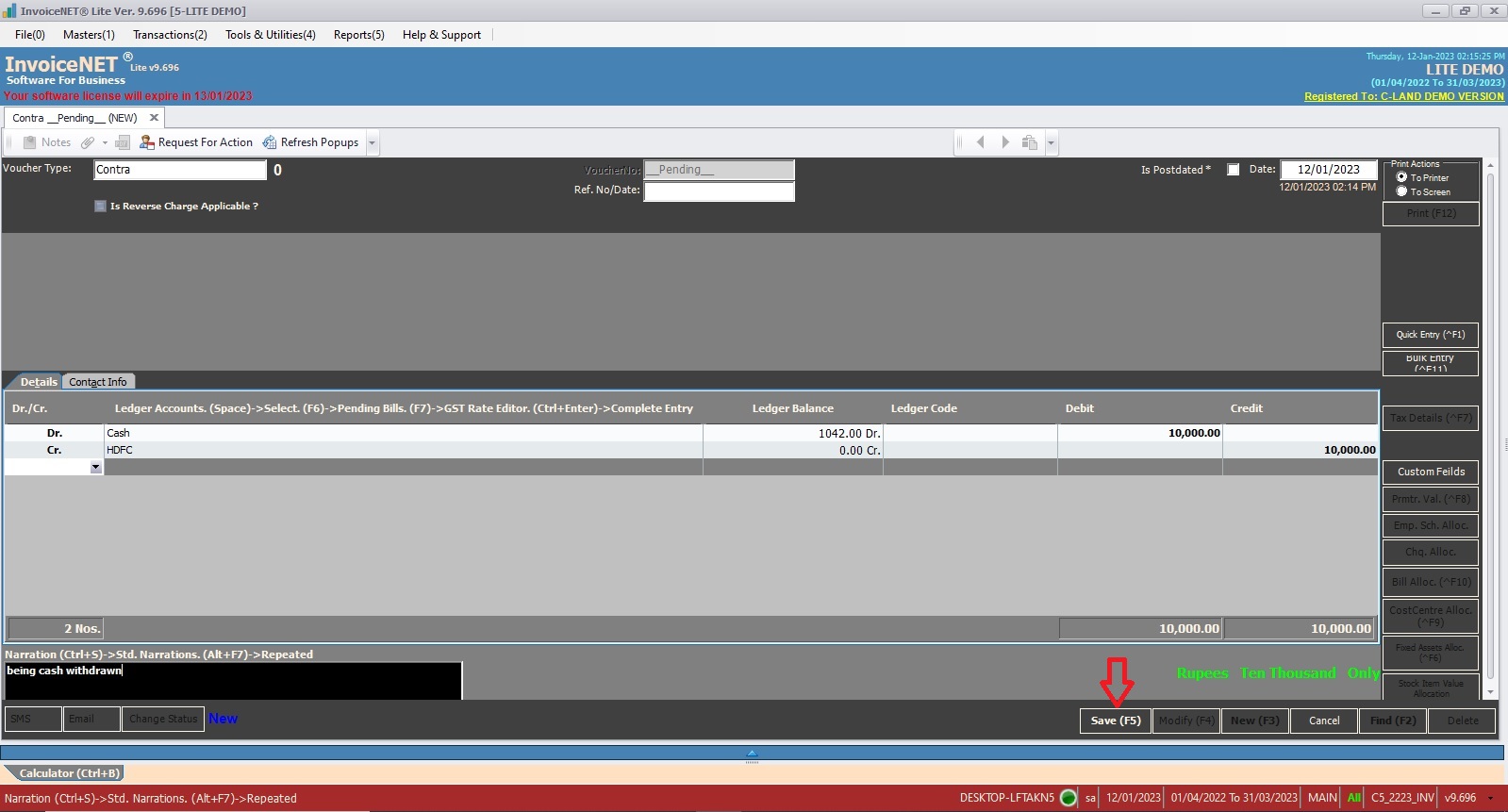

- Contra=>Voucher entries recording cash flow from bank to bank, bank to cash, cash to bank are entered in contra vouchers. In contra voucher entries the bank/cash ledgers to which cash transaction is made are debited and bank/cash ledgers from which cash transaction is made are credited.

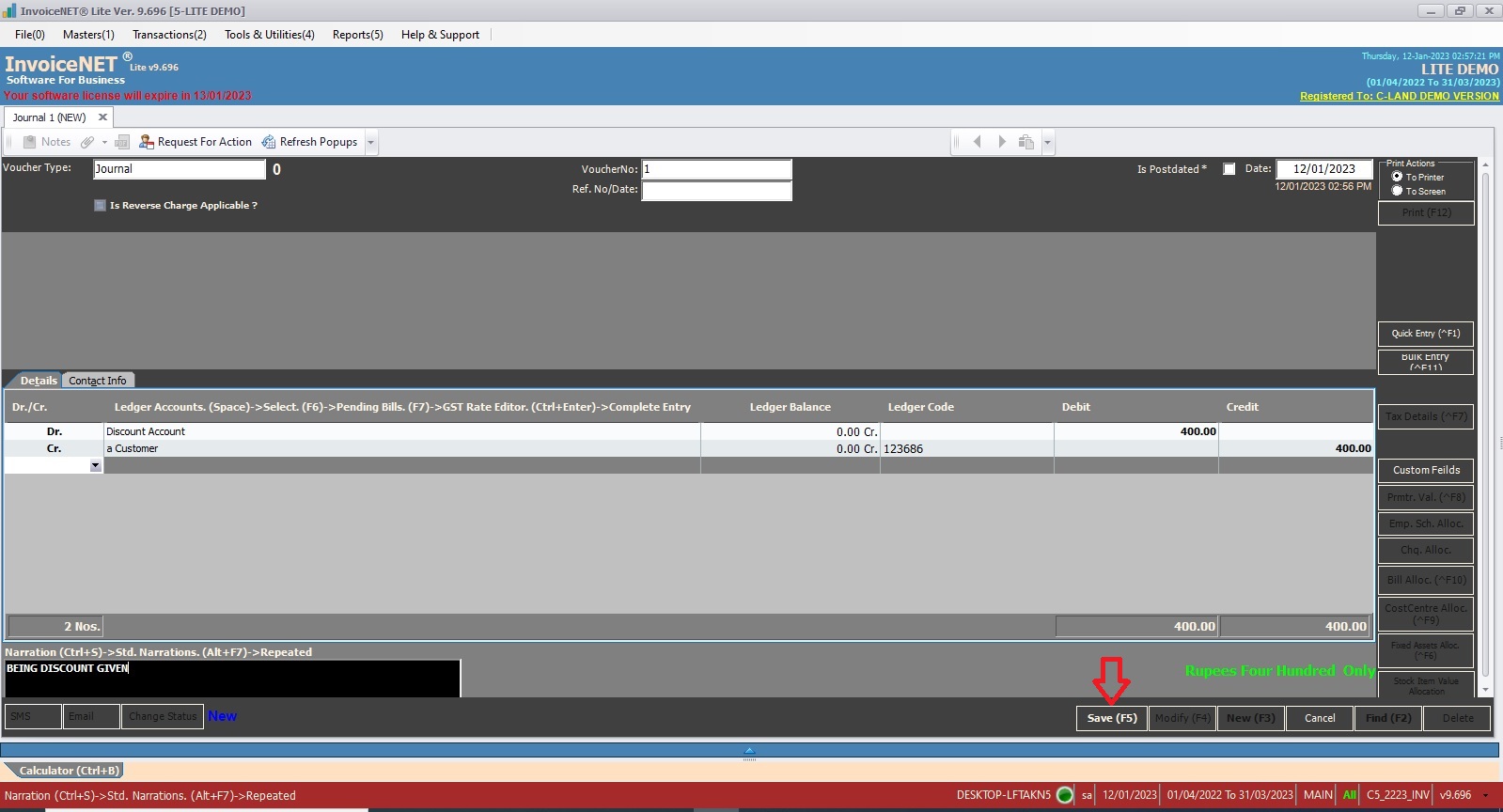

- Journal=>Voucher entries which doesn’t include bank or cash ledgers are entered in journal vouchers. They are basically meant for adjustment entries. Voucher entries recording interest incurred, interest to be paid, salary to be paid are entered in journal vouchers.

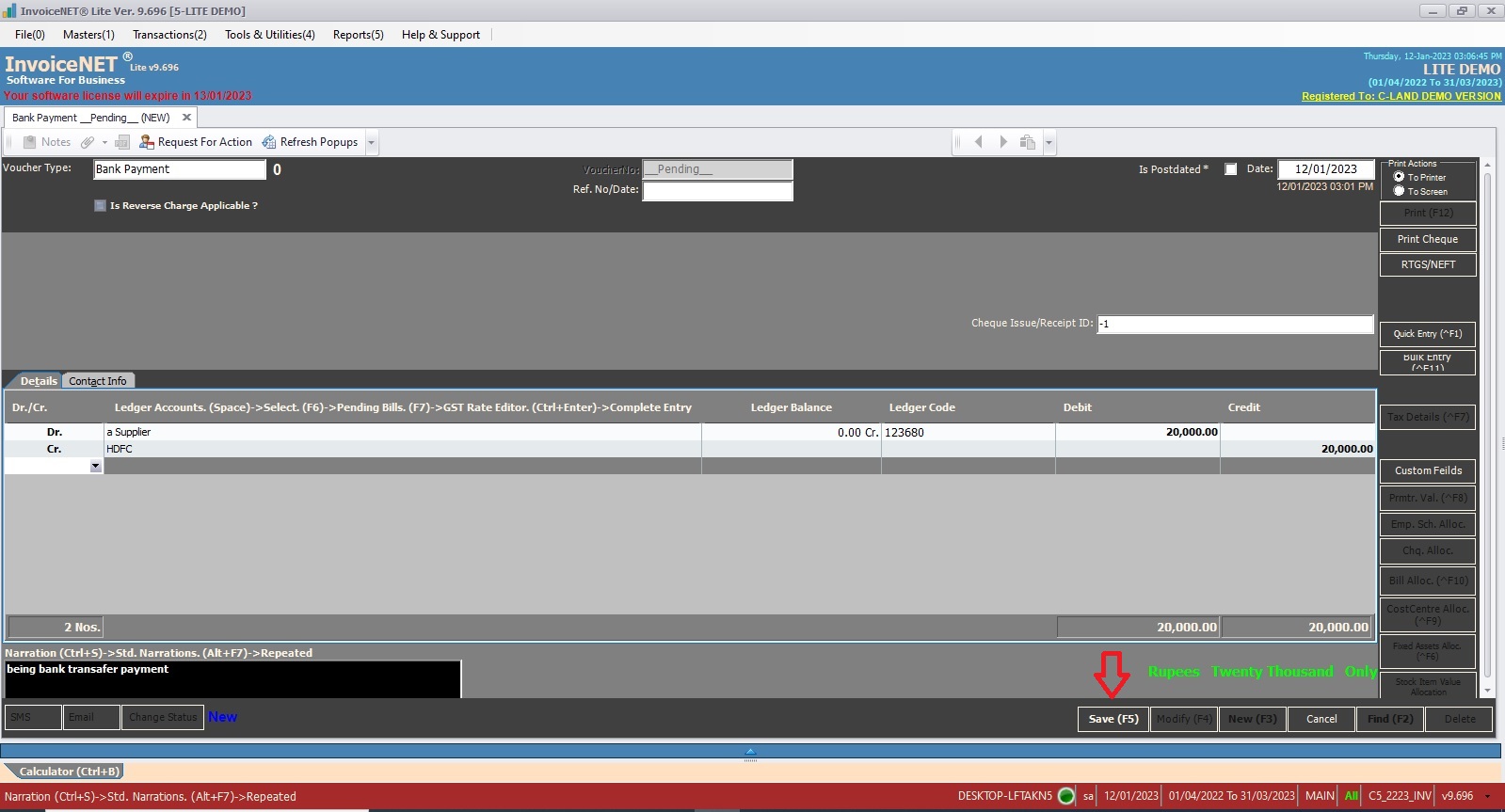

- Bank Payment=> Voucher entries recording cash paid through bank documents (cheques/DD) are entered in Bank Payment vouchers. In Bank Payment voucher entries, bank ledgers are credited and the ledgers to where the cash is paid through bank documents are debited.

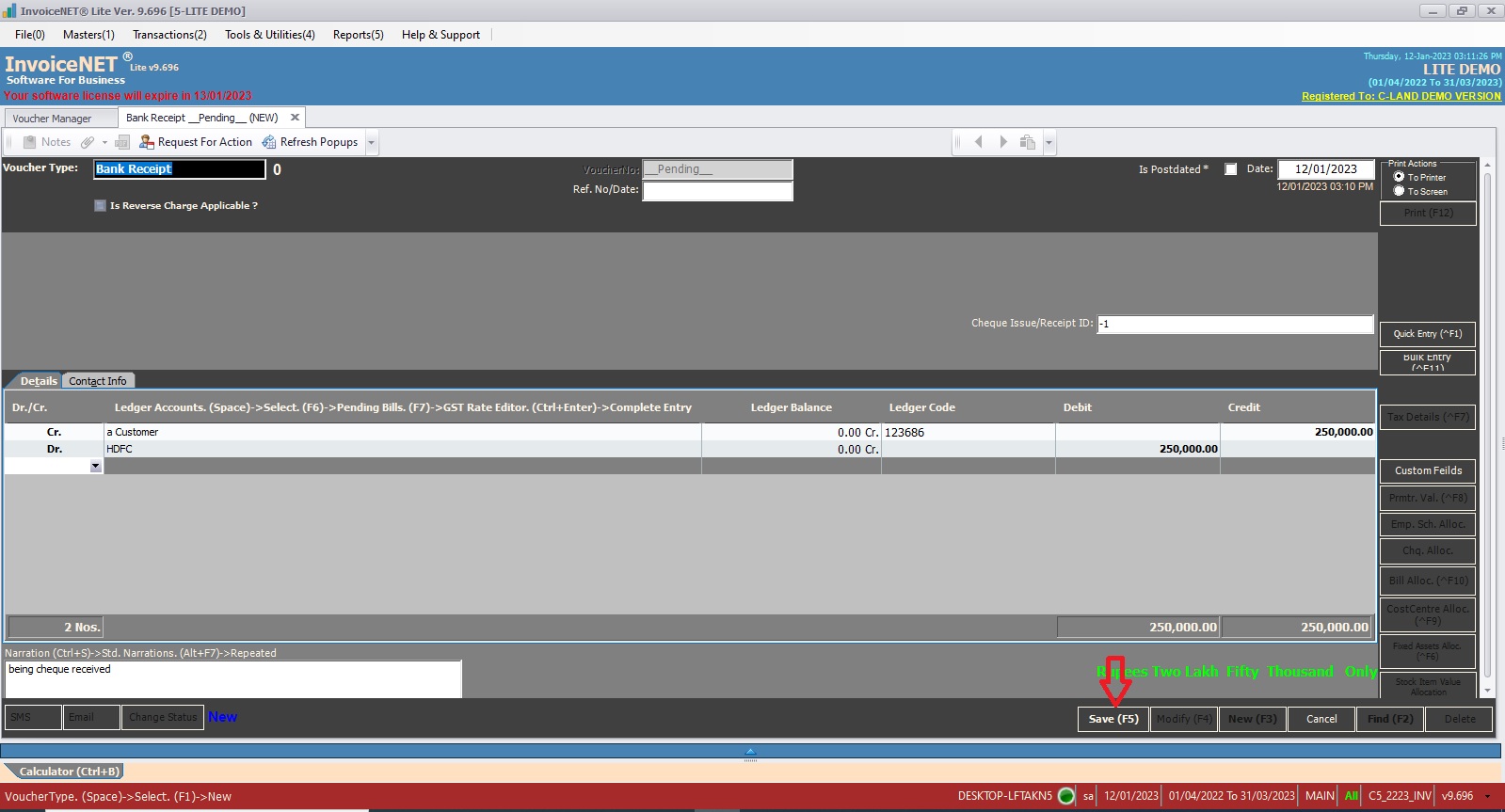

- Bank Receipt=>Voucher entries recording cash received through bank documents (cheques/DD) are entered in Bank Receipt vouchers. In Bank Receipt voucher entries, bank ledgers are debited and the ledgers to where the cash is paid through bank documents are credited.

- Cr. Note=>If the buyer returns the product, the seller usually issues a credit note for the same or lower amount than the invoice, and then refunds the money to the buyer, or the buyer can apply that credit note to another invoice. In simple, we can consider a Credit note as a ‘Negative Invoice’. Sales accounts and tax accounts will be debited and sundry debtors accounts will be credited in a credit note voucher.

- Dr. Note=> If the buyer returns the product, he usually issues a debit note to the seller for the same or lower amount than the invoice, and then recollects the money from the seller. Purchase accounts and tax accounts will be credited and sundry creditors accounts will be debited in a debit note voucher.